Something Very Strange Is Going On With Bitcoin And BTC Google Searches

Bitcoin and cryptocurrency prices are well known to be closely tied to media and general public interest–-though that could be changing.

The bitcoin price has been climbing so far this year, rising some 200% since January, though has recently plateaued at around $10,000 per bitcoin after peaking at more than $12,000 in June.

Now, it appears Google searches for bitcoin and BTC, the name used by traders for the bitcoin digital token, could be being manipulated–-possibly in order to move the bitcoin price.

t

t

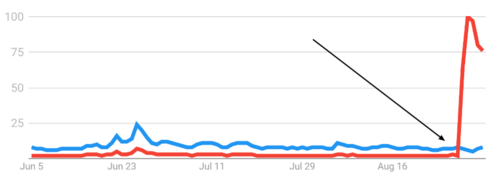

Google searches for "BTC" (red) have suddenly eclipsed "bitcoin" (blue) searches in the U.S. and around the world. GOOGLE TRENDS

This week there has been a massive leap in Google searches for "BTC," which usually is lower than searches for "bitcoin"–with search volume for "BTC" around the world now far higher than it was even at the top of bitcoin's epic 2017 bull run.

The trend may have started in Romania, Swedish cryptocurrency website Trijo News first reported.

"It is reasonable to assume that someone is behind these radical changes," wrote Kryptografen's Bendik Norheim Schei.

"That the same pattern can be seen all over the world may indicate that VPN services have been used to distribute the search across the world, thus achieving a global trend. Google Trends points out that changes have been relatively large in Romania. Is this the source, or is it just because there have been fewer searches for BTC previously? Whatever the answer is–something very strange has happened to the interest in the keyword 'BTC' this past week."

The bitcoin price has in the past tracked searches for "bitcoin" and "BTC" quite closely, with a sudden rise in searches for "BTC" without a similar rise in the price highly unusual.

Meanwhile, Totte Löfström of Trijo News, which first reported the Google search discrepancy, found that, "if you choose to display the Google Trends result for the topic 'bitcoin', all searches containing that keyword are included: 'buy bitcoin,' 'bitcoin price,' 'where can I buy bitcoin,' and so on, the number of Google searches containing the word 'bitcoin' has increased very significantly lately."

Searches for "BTC" (red) have never been higher, with Romania a possible the source of the surge. GOOGLE TRENDS

Searches for "BTC" (red) have never been higher, with Romania a possible the source of the surge. GOOGLE TRENDS

Other bitcoin and cryptocurrency analysts were quick to join Schei in pointing to potential market manipulation.

"Somebody's trying to game the trading algorithms," said Glen Goodman, trading veteran and author of bitcoin investment book, The Crypto Trader, who explained how this could be used to move bitcoin prices on the market.

"There are algorithms programmed to look at Google Trends data and try to find correlations between numbers of searches for the word 'BTC' and the movements in the bitcoin price."

"If they detect patterns, it may be profitable to trade off that data. This hacker may be buying some BTC, then sending a ton of 'BTC' search queries to Google, the algos see search numbers have risen and are triggered to buy a lot of BTC which pushes the price up, and the hacker then sells their BTC at a profit. Easy money!"

Meanwhile, it seems whoever is trying to manipulate the search results for "BTC" is doing it in an organised way.

The bitcoin price usually moves higher if Google searches for "bitcoin" and "BTC" rise, though this hasn't happened to a significant degree. COINDESK

"These searches appear to be timed to coincide with the quietest time in each country–around 4am or 5am, when search traffic is subdued, so the spam search queries will have maximum impact on the graph," Goodman added.

Billy Bambrough

I am a journalist with significant experience covering technology, finance, economics, and business around the world. As the founding editor of Verdict.co.uk I reported …

David – http://markethive.com/david-ogden