Gold Price News: Gold Falls Sharply Below $2,300 as US Data Points to Inflation

Market Analysis

Gold prices saw a sharp sell-off on Tuesday, pushing prices to their lowest level for a week, as economic figures pointed to high inflation, indicating lower chances of interest rate cuts any time soon.

It was one-way traffic on Tuesday with prices consistently moving lower through the day, falling as low as $2,294 an ounce. That compared with around $2,335 an ounce in late deals on Monday – a loss of roughly $40 in a single day. The sharp slide has taken prices back to levels last seen on April 23.

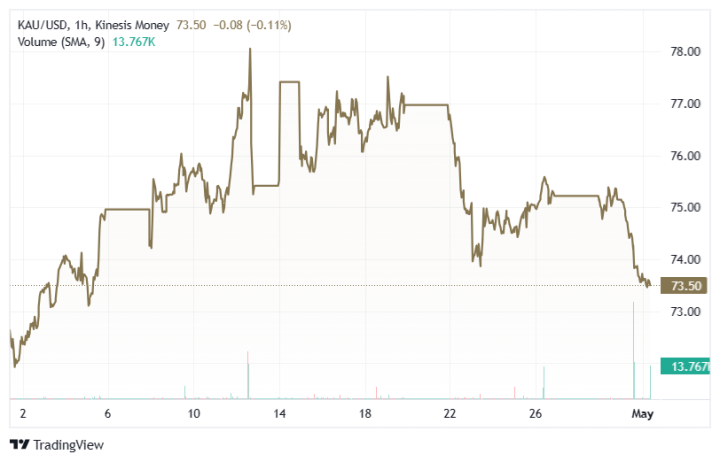

KAU/USD 1-hourly Kinesis Exchange

Euro Area GDP figures for Q1 came out on Tuesday showing stronger than expected growth, both on a quarter-on-quarter and year-on-year basis. Compounding this, the US employment cost index for Q1 released later in the day also came in above forecasts. Taken together, the latest figures indicate relatively high inflation, and this strengthens the argument for central banks maintaining interest rates at current levels.

The markets have been dialling back bets on the US Fed’s expected start of interest rate cuts taking place as soon as June. The latest figures from interest rate traders shows that bets are roughly 50-50 on a continuation of existing rates in September or a cut. A slightly stronger majority favour the first cut in November. The US Fed’s FOMC is set to meet May 1, followed by subsequent meetings in June, July and September.

Eventual interest rate cuts are seen as supportive for gold prices because they reduce the opportunity cost of holding non-yield-bearing assets like gold and silver.

Looking at a one-month gold price chart, Tuesday’s drop could prove significant if trend line support fails to hold at around $2,300 an ounce, which was the recent low seen on April 23.

Looking ahead, the markets will be watching out for Wednesday’s US ISM manufacturing PMI figures for April and JOLTs job openings numbers for March, as well as keeping an eye out for any signals from the US Fed’s meeting and subsequent press conference.

Kitco Media

Frank Watson

David – http://markethive.com/david-ogden