Gold, silver pressured amid big drop in crude oil prices

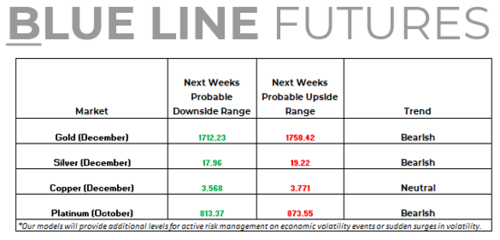

Gold and silver prices are lower in midday U.S. trading Tuesday, due in part to a drop of over $5.00 in Nymex crude oil futures prices (as of this writing). Bearish near-term technicals are also weighing on the precious metals. October gold futures were last down $12.10 at $1,728.40. September Comex silver futures were last down $0.36 at $18.31 an ounce.

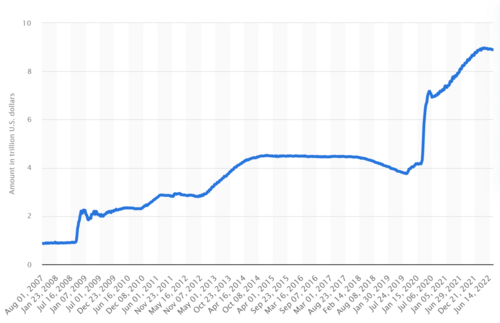

Global stock markets were mostly higher overnight. U.S. stock indexes are lower at midday. Traders and investors are still concerned about Covid lockdowns in China that are crimping the world’s second-largest economy. Last week’s hawkish speech on U.S. monetary policy by Fed Chairman Powell is also hanging over and depressing the marketplace.

The U.S. data point of the week on this unofficial last week of summer is the August U.S. employment situation report from the Labor Department on Friday. The key non-farm payrolls growth number is forecast to come it up 325,000 in August versus the July report showing a gain of 528,000 non-farm jobs.The key outside markets today see Nymex crude oil prices sharply lower and trading around $91.70 a barrel. The U.S. dollar index is a bit lower in midday U.S. trading, on a corrective pullback after hitting a 20-year high on Monday. Meantime, the yield on the 10-year U.S. Treasury note is fetching 3.08

Technically, October gold futures prices were poised to close at hit a four-week low close today. The gold futures bears have the firm overall near-term technical advantage. Bulls’ next upside price objective is to produce a close above solid resistance at $1,800.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at the July low of $1,686.30. First resistance is seen at today’s high of $1,743.10 and then at $1,750.00. First support is seen at this week’s low of $1,722.50 and then at $1,715.00. Wyckoff's Market Rating: 2.5.

.gif)

December silver futures prices hit a six-week low today. The silver bears have the solid overall near-term technical advantage. Silver bulls' next upside price objective is closing prices above solid technical resistance at $20.00. The next downside price objective for the bears is closing prices below solid support at $17.50. First resistance is seen at this week’s high of $18.70 and then at $19.00. Next support is seen at the July low of $18.175 and then at $18.00. Wyckoff's Market Rating: 2.0.

December N.Y. copper closed down 580 points at 355.25 cents today. Prices closed nearer the session low today and hit a three-week low. The copper bulls have lost the slight overall near-term technical advantage. A six-week-old uptrend on the daily bar chart has been negated. Copper bulls' next upside price objective is pushing and closing prices above solid technical resistance at 390.00 cents. The next downside price objective for the bears is closing prices below solid technical support at 335.00 cents. First resistance is seen at today’s high of 363.55 cents and then at this week’s high of 370.10 cents. First support is seen at today’s low of 354.45 cents and then at 350.00 cents. Wyckoff's Market Rating: 5.0.

By Jim Wyckoff

For Kitco News

Time to buy Gold and Silver on the dips

David – http://markethive.com/david-ogden

.gif)

.gif)

Gareth Soloway's Trading Tips: A Guide from a Master Trader

Gareth Soloway's Trading Tips: A Guide from a Master Trader.gif)

.gif)

The Ethereum Merge will be the biggest crypto event since the first Bitcoin was mined – Ran Neuner and Steven Sidley

The Ethereum Merge will be the biggest crypto event since the first Bitcoin was mined – Ran Neuner and Steven Sidley.gif)

.gif)

.gif) Credit Suisse downgrades its average gold price forecast to $1,725

Credit Suisse downgrades its average gold price forecast to $1,725