Tale of two factions – those that believe the Fed will remain hawkish, and those that believe the Fed can't

Gold prices dropped dramatically in trading today, making an intraday low of $1772.40. As of 3:25 PM EDT, gold futures are fixed at $1784.80. Today's selloff was predicated by dollar strength, with the dollar index gaining 0.90%, taking it to 94.165. That is the primary market force that made both gold and silver prices lower on the day.

Gold is currently trading down by 0.98%, and the dollar is currently trading up by 0.90%, showing that the sharp decline in gold today, the U.S. dollar was the source for the swift decline in the precious metals and the root cause of gold's $18 drop.

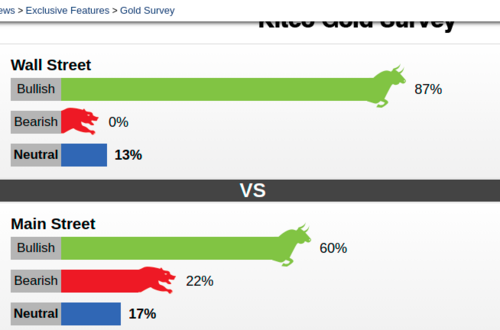

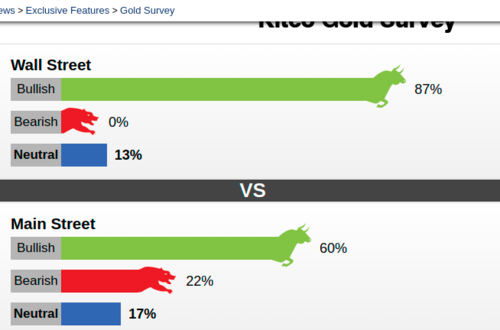

Gold's substantial price decline underscores the division of market participants split into two factions. The critical distinction between these two opposing sides is regarding what the Federal Reserve will announce on Wednesday when they conclude their FOMC meeting.

Yesterday, I stated that my interpretation of the current scenario was a rapidly declining economic recovery and a substantial rise in inflation would force the hand of the Federal Reserve to have a more dovish stance.

I am not alone with this belief, Thorsten Polleit, Chief Economist of Degussa explained the dilemma that currently plagues the Federal Reserve and ECB.

"It should be clear that a monetary policy of interest rate hikes and containment of credit and money supply expansion would be tantamount to an earthquake for the global economic and financial system – because the latest economic recovery has been driven by extremely low-interest and a most generous supply of credit and money. If central banks meant business and were to combat price inflation by raising interest rates back to 'normal levels,' a recession-depression would be inevitable."

This group of market analysts and traders believe inflationary pressures are much less transitory than the Federal Reserve is assuming. It creates an assumption that the Federal Reserve must back off and not raise rates too soon under the belief that it will devastate any economic recovery.

At the core of the opposing group's mentality is that even though recent data has shown that inflation is running hot, this heightened inflation he most part is transitory in nature and will subside next year. That faction's conviction is that the Federal Reserve will remain hawkish and announce the onset of tapering next week and lift-off next year.

Members of this camp include analysts at TD securities who said in a note,

"Traders across global markets have aggressively raised their outlook for policy tightening, as an energy crunch and snarled supply chains drive inflation higher, leading market participants to price the risk of a faster exit."

Lastly, there is another team playing off both sides' conviction and using it to their advantage. This bunch is comprised mainly of hedge funds that kept gold prices range-bound, selling into the top of the range and buying at the bottom. Phillip Streible, the chief market strategist at Blue Line Futures in Chicago, stated that these large hedge funds become active sellers each time gold crosses the key $1800 per ounce level. This group has benefited from the two opposing forces and the reason we have broken above $1800 twice but was unable to hold this key level as support.

By Gary Wagner

Contributing to kitco.com

Buy, Sell Gold and Silver, with Free Storage and Monthly Yields

David – http://markethive.com/david-ogden

.gif)

.gif)

.gif)

.gif)

.gif)

.gif)