BTC Bears Are Back, Bitcoin Slowly Weakens as Altcoins Beat a Retreat

Bitcoin has managed to hold on above $9,000 for another day but it is slowly weakening and likely to drop below that support level by the weekend. The altcoins meanwhile are already sliding further and may well dump all recent gains.

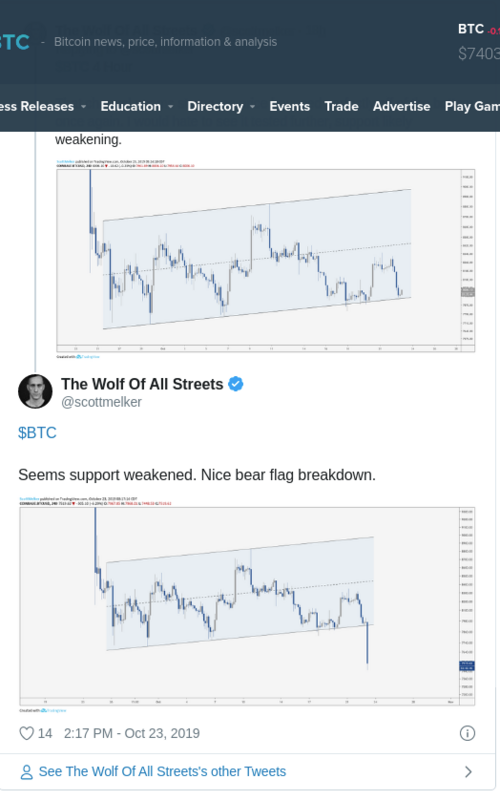

Bitcoin Support Weakening

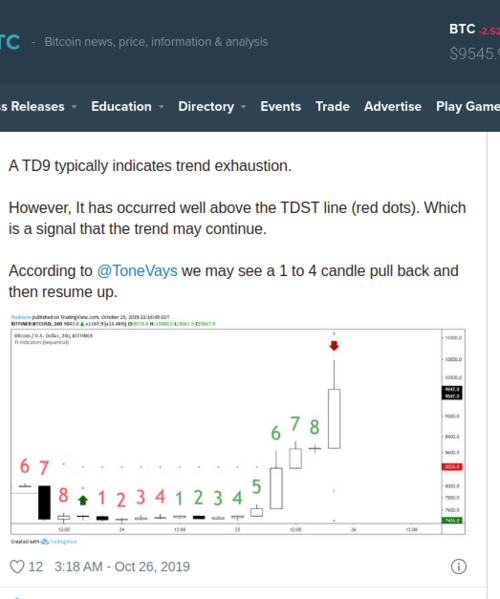

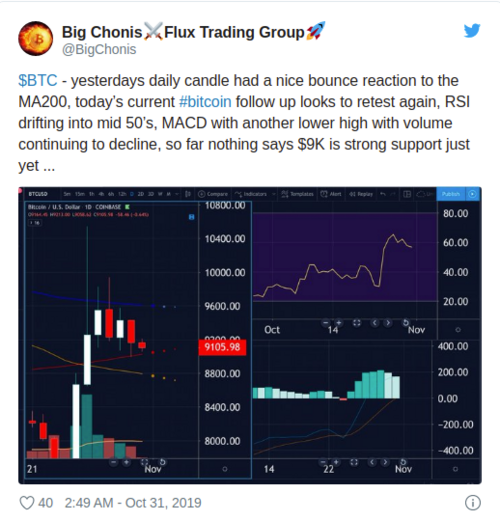

The pattern is pretty clear when looking at the Tradingview charts. A down trend has formed on the week and Bitcoin is slowly losing ground as it slides back towards $9k this Halloween day. The highest it could manage over the past day is $9,250 and a couple of hours ago BTC dropped to its intraday low of $9,050 for the second time.

BTC price 1 hour – Tradingview.com

Lower highs and lower lows indicate a continuation of this trend in the short term. Trader and analyst ‘Big Chonis’ has been doing the TA …

“Yesterday’s daily candle had a nice bounce reaction to the MA200, today’s current bitcoin follow up looks to retest again, RSI drifting into mid 50’s, MACD with another lower high with volume continuing to decline, so far nothing says $9K is strong support just yet …”

The bearish sentiment is starting to return to crypto twitter as analysts start to agree that down is more likely than up. ‘Credible Crypto’ added that a fall back to the low $8,000 level is likely.

“Either way I expect 8600-8800 to be hit sooner or later and if we clear the lows now I ultimately expect 8000-8200 to be met.”

China fever is waning and it is back to business on Bitcoin markets which were heading downwards before the huge weekend boost.

Altcoins in Pain Again

Ethereum has declined by 2.5% over the past 24 hours as it drops back to $185. ETH really needs to keep hold of these gains to prevent an eventual collapse to $150. There has been no indication that it is ready to break free from the shadows of its big brother though.

XRP just can’t break over $0.30 and has fallen back below it again today as the Ripple token loses 2%. Bitcoin Cash has also dropped 2% but it has been very bullish over the past week holding on to most of its gains. BCH is currently trading just below $290 but is primed to fall if BTC does.

Litecoin and Binance Coin are flat, hovering around $60 and $20 respectively while EOS is dumping again in another 3% fall. Following its Samsung induced pump yesterday, Tron is dumping today as a 7% slide drops TRX back to $0.020.

Around $5 billion has exited crypto markets over the past 24 hours as total capitalization falls to $245 billion. Markets are still up $40 billion on the same time last week but the bears are slowly returning and those gains are starting to erode.

Martin Young

David – http://markethive.com/david-ogden

Hiring a Consultant for Internet Marketing

Hiring a Consultant for Internet Marketing Learning more about Internet Marketing for yourself

Learning more about Internet Marketing for yourself

.png)

.png)