Gold SWOT- Demand for Gold & Precious Metals Is Running Hot

Strengths

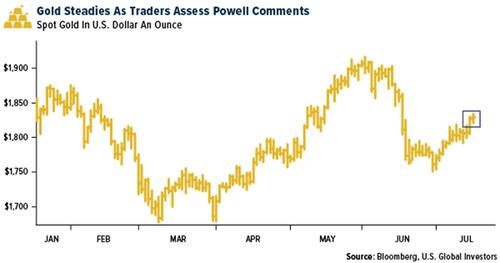

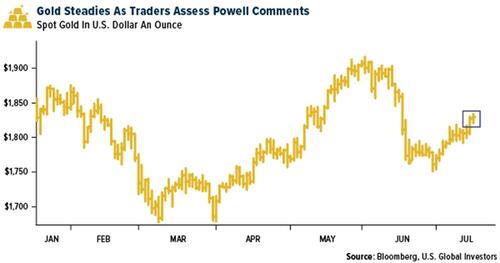

The best performing precious metal for the week was gold, up 0.21%. Gold remained stable during the week as bond yields retreated and investors weighed the outlook for global growth on concerns that coronavirus variants may threaten the economic recovery. The dip in Treasury yields last week helped boost the appeal of the non-interest-bearing metal. Gold then stabilized later in the week as the dollar and Treasury yields pared some of their gains made in the wake of U.S. inflation data that came in significantly higher than expected. Prices paid by U.S. consumers surged in June by the most since 2008, topping all forecasts and testing the Federal Reserve’s commitment to sticking with ultra-easy monetary support for the economy.

A UBS call with a leading diamond expert indicates diamond market fundamentals remain attractive with demand strong in the U.S. and China with mid-stream and producer inventories healthy. Midstream inventories have fallen to more sustainable levels due to structural changes and tighter credit, and profitability has returned. Supply fell 6% in 2020 to 119 million carats, the lowest level since the 1990s, due to curtailments/closures. Rough prices are back to pre-COVID levels, after falling 15% in the first half of 2020.

Kirkland Lake Gold reported positive production and sales information. The company produced 379,000 ounces of gold in the second quarter, 9% above consensus. Second quarter sales were 365,000 ounces, 5% above consensus. The company expects to end 2021 in the top half of 1.3-1.4-million-ounce guidance. Dundee Precious Metals reported preliminary production results for the second quarter as well, with consolidated gold output of 85,100 ounces exceeding consensus of 73,700 ounces. Gold production at Chelopech was very strong with 52,600 ounces benefiting from higher grades and improved recoveries. Performance remained solid at Ada Tepe. Dundee has produced 155,400 ounces and puts the company in good shape to aim for the higher end of the guidance range.

Weaknesses

The worst performing precious metal for the week was palladium, down 6.45% as UBS reported substitution with cheaper platinum is already taking place in auto-catalysts, becoming more pronounced in 2022. New Gold reported that weaker performance was achieved at Rainy River due to lower grades—stronger Rainy River second-half results are expected, but the mine is reportedly now on track to achieve the low end of guidance.

Fiore Gold released production for the three months ended June 30 of 11,800 ounces, slightly below estimate of 12,400 ounces from Stifel, but up 8% from the second quarter. The miss against Stifel’s numbers was driven by lower tons stacked and lower grade. The company ended the quarter with a cash balance of $18.5 million, slightly below anticipated $20.4 million.

Pure Gold announced second quarter production results. Second quarter (pre-commercial) gold production of 6,300 ounces was 40% below the 10,400-ounce forecast. Average daily mill throughput in the quarter of 509 tons per day was below the average 538 tons per day delivered in the first quarter.

Opportunities

According to the CEO of Barrick Gold, Mark Bristow, due to an aggressive near-mine exploration program, Kibali was continuing to replace its reserves faster than it was mining them, and now has a resource base that is approaching the 2013 levels when the mine first went into production. The company also said that significant exploration successes could extend the Tongon gold mine’s life. Bristow said 10 years after it went into production Tongon could get a new lease on life thanks to promising results from near-mine exploration campaigns designed to replace the mine’s depleted reserves.

AngloGold Ashanti is pleased to announce that a non-binding proposal has been submitted to the Board of Directors of Corvus Gold Inc. under which its direct wholly owned subsidiary, AngloGold Ashanti Holdings plc, would be willing to acquire for cash all the issued and outstanding common shares of Corvus. AngloGold Ashanti currently holds a 19.5% indirect interest in Corvus.

Aya Gold & Silver reported second quarter production from Zgounder of 439,100 ounces handily beating aggressive estimates of 401,700 ounces due to higher throughput and head grade. This puts the mine on track for 1.66 million ounces in 2021, well above guidance of 1.2 million ounces.

Threats

Jefferies is cautious on mining equities in the near-term as investors’ sentiment has turned more negative on the sector. The group said, “we attribute the weakness to the delta variant of coronavirus and associated lockdowns, China tightening, and fears of weaker demand as some believe global growth has peaked.”

On July 15, Barrick reported that an incident occurred at its Hemlo mine on the evening of July 14, resulting in the death of a contractor. Hemlo operations are suspended, and an investigation is underway.

Sibanye Stillwater Ltd. may wind down its three South African gold mines in the next decade or so as it becomes harder to exploit aging assets in an industry that was once the world’s largest. Sibanye, which was spun off from Gold Fields’ oldest South African mines in 2013, employs about one-third of the roughly 93,000 workers in the nation’s gold industry. Sibanye is actively seeking gold acquisitions, likely in North America.

By Frank E. Holmes

Contributing to kitco.com

Kinesis Money the cheapest place to buy/sell Gold and Silver with Free secure storage

David – http://markethive.com/david-ogden