Bitcoin Price to Surge Back to $10,000 and Enter a ‘Super Cycle', Kraken BD Director Says

Yuri Molchan

The head of business development at Kraken predicts that Bitcoin price is bound to enter a ‘super cycle’, offering a number of reasons

Bitcoin Price to Surge Back to $10,000 and Enter a ‘Super Cycle', Kraken BD Director SaysCover image via www.123rf.com

Bitcoin is heading towards $10,000 a major crypto community member says

Bitcoin is going through another recession, having briefly broken through the $10,000 level and is now back at $9,160 area. Still, the BTC price has risen by a thousand USD, from the $8,200 area.

While some believe that the world’s first crypto is going to keep declining, others, including the Kraken director of Business Development, believe that there are strong reasons for Bitcoin price to surge in the near future.

Dan Hedl: Bitcoin is perfectly positioned for a super cycle

The Kraken executive believes that the BTC price is bound to surge – several prerequisites will trigger it eventually. He mentions the recent QE actions of the US Fed and ECB, the global debt and structural risks of the global financial system that have not disappeared.

In his recent tweet, Dan Hedl says:

Hedl also recently expressed his view of the upcoming Bitcoin Cash halving, saying that this event is likely to greatly reduce the BCH hashrate and increase the risk of 51% attacks against the network.

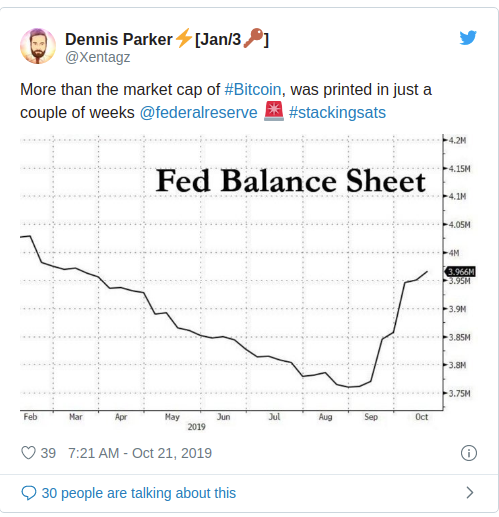

A permabull on Bitcoin, @Xentagz, has also commented on the scale of the recent cash printing actions of the Fed, saying that they have injected in the financial system more than Bitcoin’s market cap.

Happy 11th Birthday, Bitcoin! Satoshi Nakamoto's White Paper Marks New Milestone on Halloween

Bitcoin is heading towards $10,000 a major crypto community member says

On his Twitter page, @MustacheTommy, “crypto warrior” and “Proud supporter of 'Freedom of Money'", says that Bitcoin is heading towards the $10,000 level, rather than towards $6,000 as some in the crypto community believe.

He reckons that the bear market is still on, however, about half a year is left before the Bitcoin price surges to $10,000 and moves higher.

Which 'camp' are you in – do you believe that BTC will keep declining to $6,000 or hit $10,000 soon? Feel free to leave a comment in the section below!

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of U.Today. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

Yuri Molchan

David – http://markethive.com/david-ogden