Bitcoin price has hit bottom – coldest days of Crypto Winter are over – Ran Neuner and Steven Sidley

With Bitcoin’s price bottoming below $20K in June, the worst days of the Crypto Winter are over, according to Ran Neuner and Steven Sidley, who joined Kitco’s Editor-in-Chief and Lead Anchor, Michelle Makori, in a panel discussion.

“We’ve hit the crypto bottom,” said Neuner, Host of Crypto Banter, a popular crypto-themed podcast. “Crypto suffered one of the biggest liquidations we’ve ever seen. We had the LUNA ecosystem collapse, which is a $100 billion ecosystem, which caused a cascade of liquidations throughout the market.”

Sidley, Professor at the University of Johannesburg and Head of the university’s Blockchain and CryptoVerse Research Group, agreed with Neuner, albeit with a few caveats.

“There are a couple of things still staring us in the face,” cautioned Sidley, who is also a best-selling author and a Director at Bridge Capital Future Advisory. “China deciding to invade Taiwan is a possible Black Swan event. If Russia decides to step up its aggression all the way to nuclear weapons, that’s another Black Swan event… but in most respects, I agree with Ran that we’re at the end of [The Crypto Winter.]”

A Black Swan event is an unexpected occurrence that has a significant impact on markets.

Crypto Winter thawing

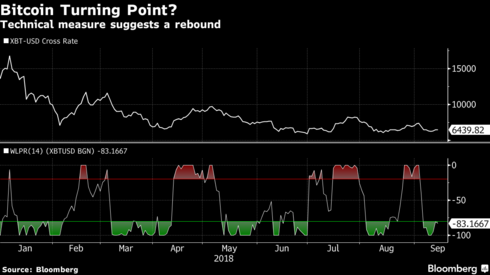

Neuner, who is also the Co-founder and CEO of Onchain Capital, used the 200-week moving average of Bitcoin to support his claim that the cryptocurrency would continue its upward rally. The 200-week moving average is the longest measure of Bitcoin’s upward trend. Bitcoin’s spot price has only moved below this metric three times: in 2015, in 2020, and in 2022.

“Every time [Bitcoin’s spot price hit the moving-average], it has rebounded and given investors huge returns,” said Neuner. “The times it has gone under the 200-week moving average have been Black Swan events.”

However, Neuner said that investors should watch the “macro environment,” which could impact Bitcoin’s price.

“For as long as the macro environment continues to perform, I think we’ll be okay,” he said. “The probabilities are about 50-50 as to whether the Fed will increase [rates] by 50 basis points or 75 basis points, and I think that the market has already priced those rate increases in. In terms of whether we’re at the bottom or not, I’m confident to say that we’ve probably hit the bottom in crypto, unless another Black Swan event happens… but I think we’ve had the coldest days of winter.”

Bitcoin adoption

Asset-management firm BlackRock recently announced a partnership with Coinbase to provide institutional clients with Bitcoin access. However, this seemed to have no significant impact on Bitcoin’s price.

“In a bear market, the market does not respond to good news, and we know that we’re very much that we’re currently in a bear market,” said Neuner. “We thought that the BlackRock news would move the market, and it didn’t at all.”

Sidley added, “The BlackRock announcement was very profound. This [firm has] $10 trillion in assets that they manage.”

However, he said that Bitcoin’s price did not move after the BlackRock announcement because of unfavorable regulatory developments.

“There’s a regulatory pushback,” said Sidley. “Whereas BlackRock may say, ‘we’re going to give our clients exposure to [Bitcoin],’ everybody’s now looking to the other side, which is the regulators who are trying to control it and slow this thing down.”

To find out Neuner and Sidley’s forecasts for Bitcoin’s price, watch the video above.

By Cornelius Christian

For Kitco News

Time to buy Gold and Silver on the dips

David – http://markethive.com/david-ogden