Bitcoin and a new Quarter – More of the Same?

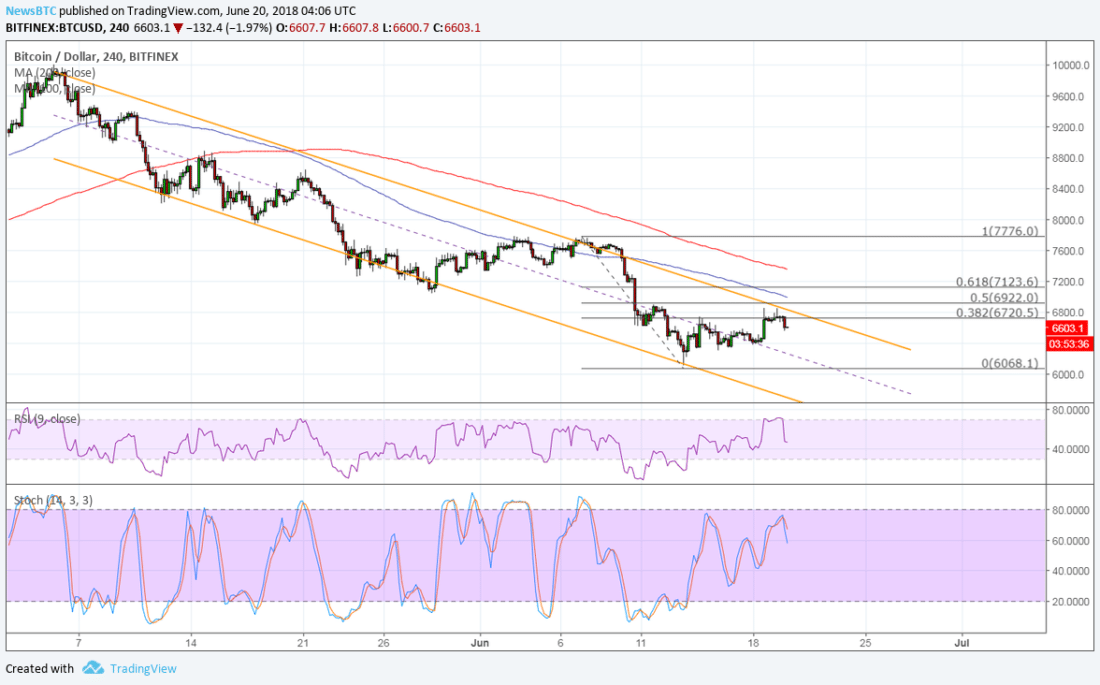

Following a solid couple of days to limit the losses for the 2nd quarter, it’s back in the red for Bitcoin at the start of the 3rd, with uncertainty continuing to pin back any meaningful rally.

Bitcoin gained 2.95% on Saturday, following Friday’s 6.12% rally, to end the day at $6,391.6, taking Bitcoin to a 3.96% gain for the current week.

Friday’s late in the day rally spilled over to the early hours of Saturday morning, leading Bitcoin through the day’s first major resistance level at $6,413.4 to a morning high $6,545.5 before easing back to hover at around $6,400 levels.

Following Bitcoin’s start of the day bounce from an intraday low $6,195.2 that left the first major support level at $5,891.4 untested, it was a relatively range bound day, with a second half of the day pullback seeing Bitcoin fall to an afternoon low $6,313.8 before recovering to the morning ranges.

For the Bitcoin bulls, the moves through the day, in response to the start of the day rally, will have given some confidence, with Bitcoin proving to be far more resilient than its peers during the sell-offs, supporting the stronger gains through the week.

There was no particularly positive news to support Saturday’s consolidative gains, with investors eyeing sub-$6,000 levels as a good entry price, in spite of calls of sub-$5,000 levels before any meaningful recovery can begin, all of which is ultimately hinged on the regulatory frameworks that are due to be rolled out in key jurisdictions over the summer.

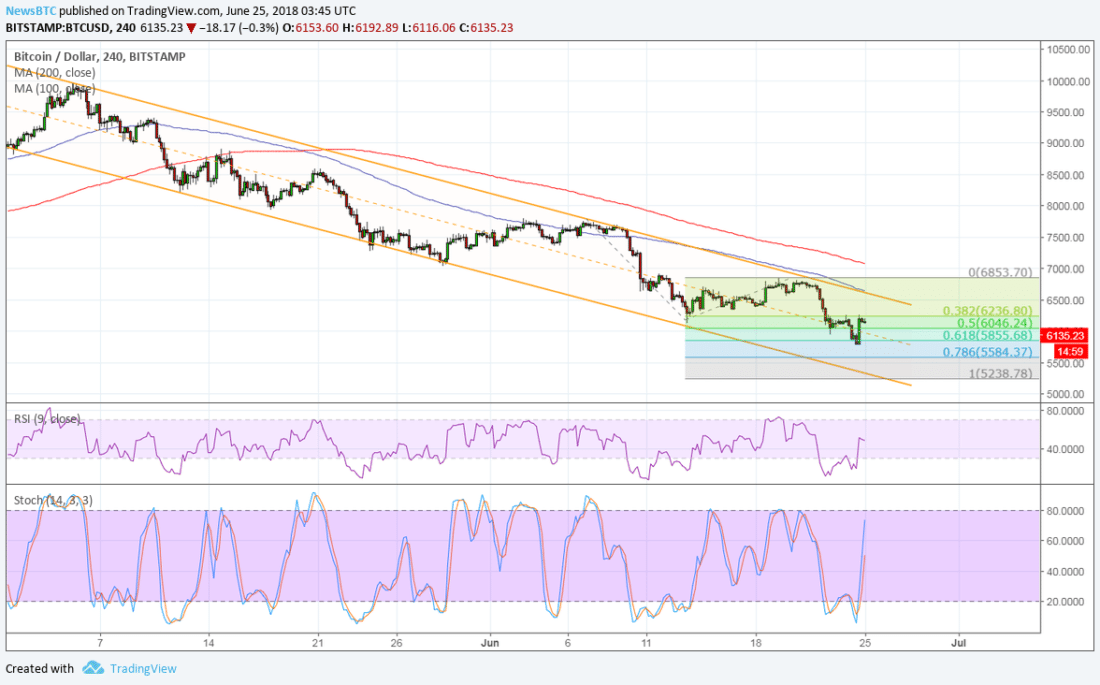

For the Bitcoin bulls, while the resilience in the 2nd half of the week will have been a positive, the reality is that the extended bearish trend, formed at 5th May’s swing hi $9,999, remains firmly intact, with Bitcoin needing to break through the 23.6% FIB Retracement Level at $6,757 to begin forming a near-term bullish trend.

The last time Bitcoin broke through the 23.6% FIB Retracement Level was on 11th June, with the bearish trend having seen Bitcoin strike a number of swing lo prices since.

Get Into Cryptocurrency Trading Today

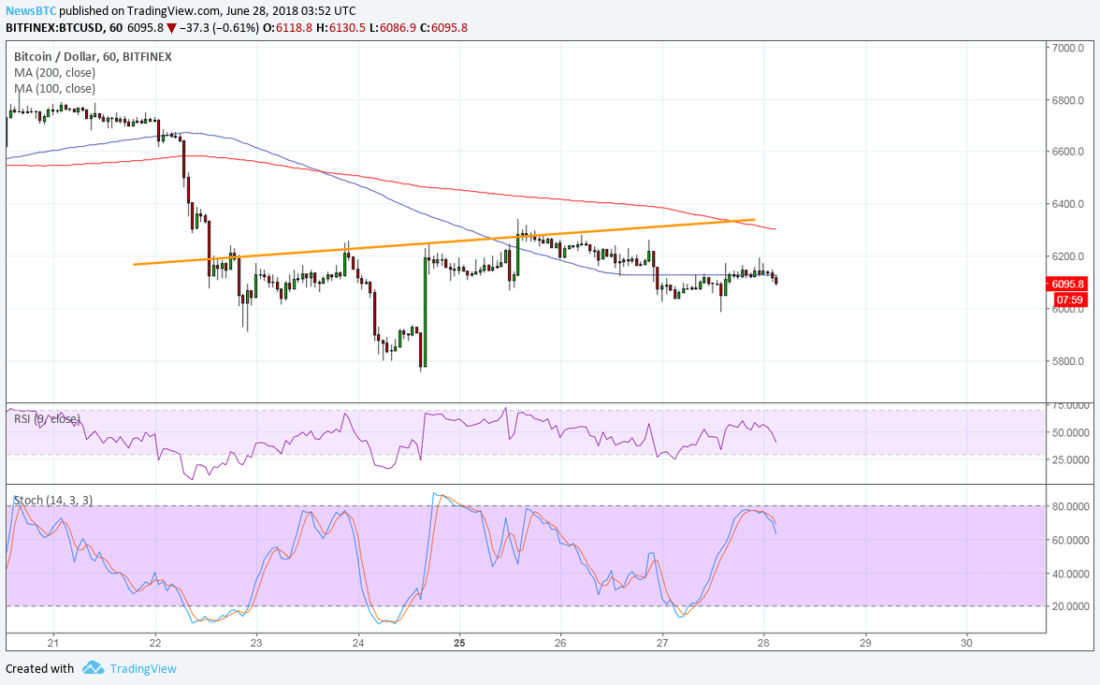

At the time of writing, Bitcoin was down 0.69% to $6,347.2 in what’s been another range bound start to the day, relative to the broader market.

A start of the day $6,439.9 high fell short of the first major resistance level at $6,559.67, with an early morning $6,322.9 low holding well above the first major support level at $6,209.37, as Saturday’s consolidation saw Bitcoin steer clear of sub-$6,000 levels for the first time in 4-days.

For the day ahead, a move back through the morning’s $6,439.9 high would support a run at $6,500 levels and the day’s first major resistance level at $6,559.67, though Bitcoin will need to break back through $6,400 levels that may provide stern resistance should a rally not kick in later in the morning.

Failure to take a run at $6,500 levels to bring the day’s first major resistance level into play could see Bitcoin catch up with the broader market to bring the day’s first major support level at $6,209.37 into play before any recovery, the day’s second major support level at $6,027.13 and sub-$6,000 support levels likely to be left untested through the day.

With Bitcoin ending the month of June down 14.6%, things could have been much worse considering the length of the extended bearish trend, which may provide some degree of comfort to the cryptomarket, though until the regs are rolled out, the uncertainty of what lies ahead will remain a factor that will likely pin Bitcoin back from any meaningful rally near-term.

Bob Mason 32 minutes ago

David – http://markethive.com/david-ogden