Cardano – The 3rd Generation Blockchain

– Where Philosophy Meets Science And Technology

What is Cardano?

Cardano is not just another altcoin. It is an actual blockchain similar to Ethereum as it is a smart contract platform, however, Cardano offers scalability through a layered architecture. Cardano’s approach is unique in this space itself as it is built on scientific philosophy and peer-reviewed academic research. It was conceptualized by Charles Hoskinson who is a co-founder of the Ethereum Blockchain and a number of other projects.

While Ethereum does an admirable job as a smart contract platform, according to Hoskinson it is a second-generation blockchain and needed evolution. What makes Cardano extremely remarkable is the absolute amount of care that goes into its preservation. There are three organizations that work fulltime to develop and take care of Cardano. They are,

The Cardano Foundation

IOHK (Input Output Hong Kong)

Emurgo

These three organizations work in synergy to ensure the development of Cardano is tracking at a good pace.

The Origin Of Cardano

Cardano started as a project in 2015 with real high aspirations. The model they chose to follow was a darker program that was a very risky, big, sexy, juicy, huge problem according to Charles Hoskinson when he spoke at the Cardano 2nd Anniversary meetup in Bulgaria on September 28th, 2019. The project focussed on lots of high-risk high return science with a view to see where it took Cardano and somewhere along this journey try to trim it down to a point where the company could build a product and commercialize it.

After untold hours of research, enormous testing of protocols, 40 white papers and attending many rigorous academic conferences and highly scrutinized. Cardano found its niche and is positioned to be a force as its addressing the ongoing issues other cryptos and blockchains are inherently having.

Cardano was launched in Sept of 2017 Cardano and now on its 2nd anniversary is leading the charge doing great things in terms of development, communication and building a better crypto project.

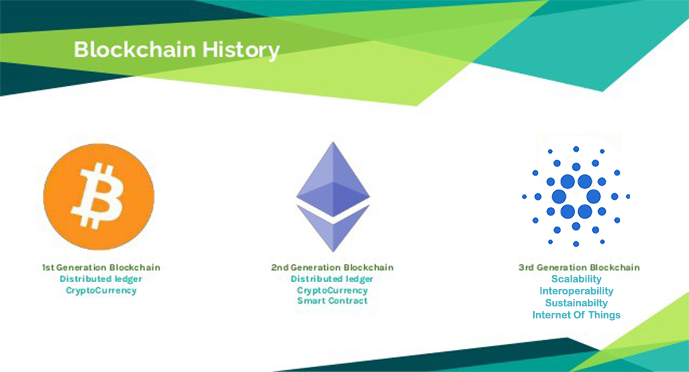

The Three Generations Of Blockchain

Ist Generation Blockchain. Bitcoin and Money Transfer – People were asking the questions, Is it possible to create a form of money that can be transferred between two people without an intermediary? Also is it possible to create a decentralized currency on a distributed ledger like a blockchain? Satoshi Nakamoto answered these questions by creating Bitcoin. However, there was a problem with Bitcoin and for all first-generation blockchains in that, they only allowed for monetary transactions and there was no way to add conditions to those transactions.

For example, Tom can send Jerry 2 Bitcoin for a service he provides, but he couldn’t tell Jerry that he will get the payment only when he provides the service. These conditions would need extremely complicated scripts. “Something” was needed to make this process more coherent.

2nd Generation Blockchain Ethereum and Smart Contracts – The “something” that was needed was a smart contract. Smart contracts assist you in exchanging money, property, shares or anything of value in a transparent, conflict-free fashion without the services of a middleman. Ethereum demonstrated to the world how the blockchain can evolve from a simple payment system to something a lot more powerful and significant.

However, this generation had some issues too. As many more interesting use cases were being created they were obtaining much more recognition. The issue was the fact that this generation of blockchain ultimately didn’t have a good foundation for scalability. Also, the governance system was not particularly that well thought through. According to Hoskinson, the Ethereum and Ethereum Classic split is a prime example of bad governance.

3rd Generation Blockchain – Cardano – Through years of experience along with trial and error, Charles Hoskinson knew that the blockchain needed to evolve even more. He took the positive elements from the first two generations of blockchain and added some elements of his own. Hence Cardano was born. The three elements Cardano needed and wanted to solve where,

- Scalability

- Interoperability

- Sustainability

I will get to the nuts and bolts of how Cardano will approach these three elements in the next article. It’s mind-blowing! It has to be said that Cardano is unique because it is essentially built on scientific philosophy and peer-reviewed academic research. It has the ultimate goal of being “High Assurance Code” and all the engineering that goes into it will ensure that there is a much higher belief in the quality of code used. This will prevent future cases like the ETH-ETC split from occurring, according to Hoskinson. At the end of the day, the project will be 250 times more decentralized than Bitcoin with much less power needed to run it, approximately 10 kilowatts to run a global system. This is classed as a miracle of science and the miracle of good engineering.

The Philosophy Of Cardano

Cardano is a project in an effort to change the way cryptocurrencies are designed and developed. The overall focus beyond a particular set of innovations is to provide a more balanced and sustainable ecosystem that better accounts for the needs of its users as well as other systems seeking integration.

In the spirit of many open source projects, Cardano did not begin with a comprehensive roadmap or even an authoritative white paper. Rather it embraced a collection of design principles, engineering best practices, and avenues for exploration. These are taken directly from the Cardano website and they include the following,

- Separation of accounting and computation into different layers

- Implementation of core components in highly modular functional code

- Small groups of academics and developers competing with peer-reviewed research

- Heavy use of interdisciplinary teams including the early use of InfoSec experts

- Fast iteration between white papers, implementation and new research required to correct issues discovered during review

- Building in the ability to upgrade post-deployed systems without destroying the network

- Development of a decentralized funding mechanism for future work

- A long-term view on improving the design of cryptocurrencies so they can work on mobile devices with a reasonable and secure user experience

- Bringing stakeholders closer to the operations and maintenance of their cryptocurrency

- Acknowledging the need to account for multiple assets in the same ledger

- Abstracting transactions to include optional metadata in order to better conform to the needs of legacy systems

- Learning from the nearly 1,000 altcoins by embracing features that make sense

- Adopt a standards-driven process inspired by the Internet Engineering Task Force using a dedicated foundation to lock down the final protocol design

- Explore the social elements of commerce

- Find a healthy middle-ground for regulators to interact with commerce without compromising some core principles inherited from Bitcoin

Why Are We Here?

Below are excerpts from a Keynote Speech made by Charles Hoskinson, heading the Cardano Project. Passionate reasoning as to why we are in need of major change for the betterment of all on a global scale and its coming.

“The reason why we’re here and why this industry exists is because the world is changing. The philosophy of the world is changing, the way the governments work is changing due to the pressures of instantaneous, instant availability of information and value from the internet and also from globalization. We no longer live in our little silos or hierarchies with standard narrative fictions that have existed for centuries. The people in 3rd world countries can have just as much impact on the world as the people in the United States now. They have the same access to information as the rest of the world. This is changing everything, it’s creating friction and is why we have upheaval and unrest, financial collapses, etc.

The point of our blockchain and crypto industry is we are providing a toolbox, a collection of visions of where we can take the world. Where we can collectively decide on how to solve problems whether it's environmental, governance, wars or resource allocations, without there being some central country in charge. Or without building some giant meta government that gets rid of a nation-state.

The magic of the blockchain industry is that we in a completely decentralized, libertarian private way are having conversations about re-inventing money, consent, and property rights, in fact, the very structure of the world. The point of Cardano has been to be a model of how to do this.”

As a whole, the protocol’s design is geared towards protecting the privacy rights of users, while also taking into account the needs of regulators. In doing so, Cardano is the first protocol to balance these requirements in a nuanced and effective way, pioneering a new approach for cryptocurrencies.

Charles Hoskinson also pointed out that by definition, decentralized meant that no one was in charge and no one unilaterally could decide. However, for it to take the shape of a sustainable system, there should be clarity in terms of “who pays and who decides the future”.

“…so basically if you're going to decentralize the system and hand it over to the people you need to build up a critical mass of people who are capable of running the system. There are two ways of doing this, you can just fork and say good luck, everybody, bye-bye, or you can go ahead and build a safe sandbox, and pay people in that sandbox, allow businesses and knowledge and domain expertise that build up within in it and at some point when you bubble over and get a critical threshold you can pull it into the main system.”

In addition, while the platform has been solidly composed, Cardano also recognizes the need for it to evolve and adapt to changing needs. Consequently, they have designed a system that can be upgraded by way of soft forks, and are installing a treasury system that will ensure the sustainability of the protocol.

What’s In It For Markethive?

With Cardano’s latest technology resolving present-day blockchain issues, it makes sense to switch to the Cardano blockchain which will be ready in 2020. Markethive will still have its own blockchain but with the support and protocols of an exceptional 3rd generation project. Let’s face it, technology doesn’t standstill. It’s always progressing finding new and better ways to improve systems and this is a good thing.

This negates any problems with scalability as Markethive and its coin grows, unlike Bitcoin and Ethereum. This also speeds up the development of the wallet and fits in perfectly with Markethive’s plans of quantum computers. Markethive is currently on Cardano’s sandbox platform, testing the system, getting ready for the blockchain launch next year.

Conclusion

Cardano is not only built on steadfast philosophy but also on dedicated science. That alone gives it a significant edge over its competitors. Being lead by Charles Hoskinson only adds more credibility. The platform is multilayered and gives the system the elasticity to be easily maintained. Cardano uses a Proof-of-Stake system, reducing the number of electricity requirements and improving its scalability. Another feature of Cardano is its Recursive InterNetwork Architecture that allows for the existence of a subnetwork within the main network, which also makes it easier for a network to grow.

Cardano aims to become an “Internet of Blockchain,” making it possible for all cryptocurrencies to exist side by side and be converted from one to another without intermediaries. Cardano will also allow users to attach metadata to their transactions if they want to, making the network friendlier to banks and governments.

Completely open-source and patent-free, Cardano was built in a spirit of collaboration. And engineered for efficiency and scalability, the Cardano ecosystem is developing out into the most complete and most useful cryptocurrency and blockchain ever constructed.

David Ogden

A Crypto/Blockchain enthusiast and a strong advocate for technology, progress, and freedom of speech. I embrace "change" with a passion and my purpose in life is to help people understand, accept and move forward with enthusiasm to achieve their goals.

David – http://markethive.com/david-ogden