Bitcoin {BTC}-based DeFi project takes its services to Latin America

One of the main objectives of Bitcoin is to decentralize finances, allowing bitcoiners to manage the sending and receiving of money themselves. Among the community of users and entrepreneurs around this cryptocurrency, the fulfillment of this goal has led some to create products to facilitate the work, such as Decentralized Finance (DeFi) projects.

To learn more about this movement, CriptoNoticias contacted the co-founder of Ledn, Mauricio Di Bartolomeo, a Venezuelan who is working with these products. The project offers a loan and financing platform that works with bitcoins, savings accounts that pay interest on this cryptocurrency since May and also with dollar loans, backed by BTC.

DeFi: a standard for decentralization

As Di Bartolomeo explained, for him DeFi is a movement to generate a standard among ecosystem projects, focused on creating loan solutions or other financial instruments with bitcoins and other cryptocurrencies. “DeFi is a way to create a protocol that standardizes these types of projects and adds liquidity to a platform,” said Di Bartolomeo.

In this scenario, bitcoin is a pioneer and from it, a whole new class of assets is created, the altcoins. “On the basis of bitcoin you can build an apolitical financial system because it is a free transit asset worldwide and if you get your money there will be easier to move,” said Di Bartolomeo.

When you create several digital assets you can start lending an asset with the backing of another, and the opportunity to create this type of protocol is created. With a series or more of a native digital asset, financial transactions can be made between that pair. The more they are added, the more possibilities there are.

Although many DeFi projects use the Ethereum platform, for Di Bartolomeo the financial system alternate to the traditional system must be built “around Bitcoin.” In this case, the idea is to take advantage of the surplus of bitcoins that individual or institutional investors may have to offer them a return on investment and, in turn, offer the opportunity to other users to obtain these bitcoins if they so require. Ledn seeks to facilitate this bitcoin broker through loans and savings accounts in BTC.

A DeFi project that uses bitcoin Bartolomeo called Ledn a kind of bank, but only for the services, it offers. “They are simple services that seek to make people operate with something they are already familiar with and can use it,” he said. In this case, unlike centralized banking, the idea is to use bitcoin to add and disperse capital, so that the economy around the cryptocurrency can be mobilized.

The company has two main products: a bitcoin savings account, which pays interest on the bitcoins deposited, and the dollar loans backed by them. In the case of the loan, the company gives the customer 50% of the price of what it deposits as collateral. «They are still your bitcoins, only that they are under warranty. We issue a credit for half the price of those bitcoins and you can pay it at any time, ”said the Venezuelan.

The co-founder of Ledn explained how a loan could work, using, for example, about USD 1,000 in bitcoins as collateral. In this case, the company grants a USD 500 credit, but if the price increases 20% and the user has USD 1,200 in their bitcoin deposit, canceling the USD 500 Ledn returns the full BTC. “The idea is that you can always keep your BTC for a longer period of time,” said Di Bartolomeo.

Users of this DeFi project can process USD 350 loans, using bitcoin as collateral. In the case of savings accounts there is no minimum amount: “Any person can make a deposit of any amount and start earning interest,” he said.

Expansion to Latin America

It is possible to obtain Ledn credits in Canada and some users have open credits in Sweden and Switzerland. Services are also available in Mexico, Venezuela, Colombia, Argentina, Panama, Peru, and Costa Rica for 4 weeks. While the savings account is available worldwide, except in some US states and some sanctioned countries. Nor is Mexico due to the Fintech Law, according to Di Bartolomeo.

Since its activation in Latin America, web traffic has varied, focusing mainly on the continent.

Traffic has been greater from Latin America than from Canada for the first time in our history. In addition, new users have also been many more from Latin America. As we go now, the direction I see is that we will have about 10,000 users on the continent by December

However, despite the fact that the web has more traffic from Latin America than from Canada, the North American country is still Ledn’s main market.

On the other hand, one of the striking elements of the proposal is that interest is calculated and paid in bitcoin, using a 5% rate. Users must have their BTC at least 30 days on the platform in order to receive these interests.

The amount paid is used as a tax base for the calculation of interest for the following month. These loans do not generate taxes. Since the client does not buy or sell the BTCs to obtain the dollars, there is no sale operation to calculate the effective tax.

Security measures

Regarding security, given that the services involve the custody of bitcoins, either as collateral for the debtor as savings, Ledn is associated with BitGo.

We have direct API integration to BitGo and when users send us the BTC they are sending them to BitGo. That way we protect ourselves because they have the best insurance policy in the industry, for USD 100 million with the Lloyds of London.

In addition, any transaction greater than 1 BTC is verified with a video call. They have also established a multi-signature structure ( multi-sig ) within the organization to initiate, authorize and process transactions. “We have several measures to avoid any kind of attack,” said the executive on cybersecurity measures.

He added that bitcoin facilitates the issuance of credits as customers access them based on an asset they already own. This is a measure that seeks to protect the credit that Ledn issues, and that is why they work with bitcoin as collateral, as a guarantee of that credit.

It should be said that, in the event that the price of BTC is reduced so that the 50% granted in dollars represents a value greater than that retained by the guarantee, the company reserves the right to sell these funds to “balance” the loan , as Di Bartolomeo said. The other way is for users to deposit a bit more bitcoin, increasing the guarantee.

«We require that you put a little more collateral or pay a little credit to rebalance the credit (…) We have the authority and the right, according to our rules of use, to sell a portion of the collateral to repair the credit portion that is necessary, so that we rebalance it to 50% of the value that is under guarantee ”, he stressed.

Positive reception

Di Bartolomeo described the reception of DeFi services by the public as “great”, adding that he believes this is because they are solving a real problem for several bitcoiners profiles.

«If you are a bitcoin company and you have cash flow problems and do not want to sell the BTC, or if you are a person who has a position in BTC and cannot access credits, we seek to solve that problem. We also provide credits for those who want to buy more BTC. With all this, the uses of the product are increased, ”he explained.

On the other hand, it is clear to the executive that many people want to receive passive income from the bitcoins they own. There are also many others who do not want to store their cryptocurrencies in risky places. Therefore, Ledn services aim to help these people in the management of their finances, said Di Bartolomeo.

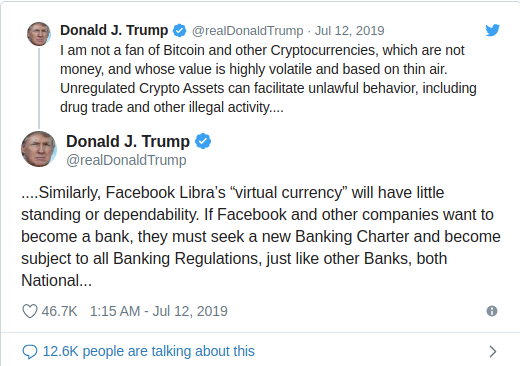

Bitcoin: a revolutionary tool

We take this opportunity to know the opinion of Di Bartolomeo about bitcoin which, after all, is the basis of all the services offered by the company. The Venezuelan described bitcoin as a “revolutionary” tool, which allows transferring value in a decentralized way, without borders.

For me, Bitcoin is a revolutionary tool that allows you to transfer value in a completely decentralized way around the world, in real-time, in a very similar way to what the Internet allowed to transmit from one end of the world to the other in real-time.

Mauricio Di Bartolomeo, co-founder, Ledn.

The businessman said that bitcoin can significantly change the options that the citizens of the world have on their capital. He considers that “there are more good people trapped in bad countries than bad people trapped in good countries.” For these people, bitcoin can be extremely useful for civil resistance to authoritarianism and government control. This cutting-edge technology gives people control over their capital. The DeFi standard could deepen this potential.

BY MIU LIN ON AUGUST 19, 2019

David – http://markethive.com/david-ogden