Gold price today – Yellow metal trades lower amid volatility, but may move above Rs 40K soon

Pritam Patnaik of Reliance Securities advised buying gold February in the range of Rs 39,900-39,850 with a stoploss at Rs 39,790 and target of Rs 40,100 levels.

1. USA | The largest economy in the world has the most gold, nearly double of Germany, at 8,133.5 tonnes.

Gold futures traded lower amid volatility in the morning on January 20, after rallying more than a percent in previous three trading sessions on the hope of improving consumer demand following the phase one trade deal signed between the United States and China.

The February gold futures contract was trading at Rs 39,890 per 10 gram on the MCX, down Rs 56 or 0.14 percent, at 0905 hours IST. It closed at Rs 39,946 on January 17, after rising 1.26 percent in three consecutive sessions.

Experts expect prices to cross psychological Rs 40,000 mark soon as it continued to hold its support levels.

"MCX Gold February have well sustained above Rs 39,700 levels which indicates positivity. On a daily chart, gold has sustain above 21-daily moving average which is placed at Rs 39,360 levels which will act strong support to the counter," Pritam Patnaik of Reliance Securities told Moneycontrol.

Rakesh Jhunjhunwala raises stake only in Titan in Q3; most small, midcaps in his portfolio gain

Market Headstart: Nifty50 likely to head higher; TCS, RIL in focus post Q3 results

Oil surges as Libyan pipeline shutdown cripples output

On the hourly chart it has given a positive crossover of 50*100 hourly moving average which is a positive crossover, he added.

He advised buying gold February in the range of Rs 39,900-39,850 with a stop loss at Rs 39,790 and target of Rs 40,100 levels.

Manoj Kumar Jain of IndiaNivesh Commodities also feels if the gold sustains above Rs 39,800, then it could test Rs 40,050-40,200 levels.

In the international, gold prices traded at $1,558.50 per troy ounce, down 0.11 percent as strong US economic data is likely to increase demand for riskier assets, hence there could be less demand for safe haven.

"International gold has sustained above $1,550 levels which will hold as support & upside $1,563 will act a strong resistance. It may trade in $1,550-$1,562 range. Break above $1,563 will take prices towards $1,575 levels," Pritam said.

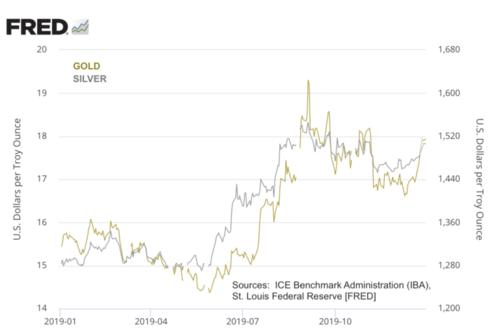

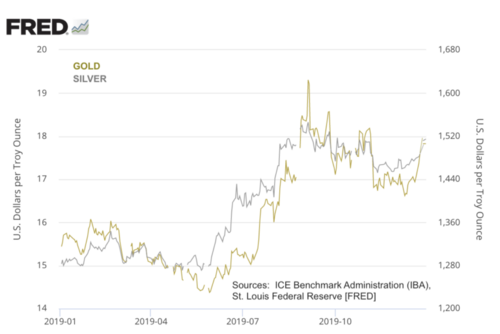

Gold and silver prices rebound on Friday in the international market. Prices gained for the second day in a row and spot gold closed above $1,550 per troy ounce and silver prices closed above $18 per troy ounce. Both precious metals gained after mixed setup numbers from the US and other economies on Friday.

Prices also get support on the hope of rising consumer demand after signing first phase trade deal between US-china.

"We expect both the precious metals to remain range-bound and will continue to get support at lower levels. Gold prices sustain above $1,550 could test resistance level of $1,564-1,572 while $1,542 act as a major support in the international market," Manoj Kumar Jain, Director, IndiaNivesh Commodities told Moneycontrol.

MCX silver February futures traded at Rs 46,621 per kg, down Rs 135 or 0.29 percent at 0905 hours IST. It closed at Rs 46,756 on Friday, up 1.86 percent in previous three days.

"Silver prices are expected to hold support levels of Rs 46,400 and if it sustains above Rs 46,850 then it could test Rs 47,100-47,400 levels again," said Manoj Kumar Jain.

According to him, in the international market, silver prices if sustain above $18 per troy ounce then it could test $18.18-18.40 per troy ounce levels. "$17.70 continues to act as major support."

Moneycontrol News

@moneycontrol.com

David – http://markethive.com/david-ogden

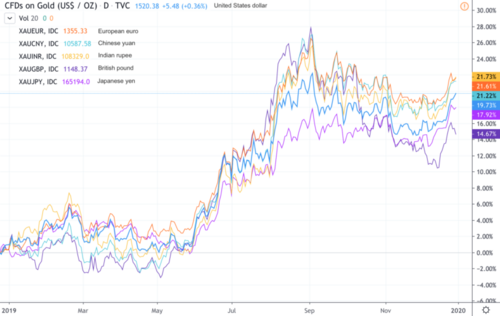

“Gold has had one of its more excitable runs since the start of the year. It surged so much in the wake of the Iran airstrikes that it even drew the attention of the broadsheet financial press. So naturally, the price was bound to tank shortly afterwards. Which is precisely what happened this morning. If you’re a gold investor, you might be fretting that gold’s high point for 2020 has already come and gone. I wouldn’t worry.”

“Gold has had one of its more excitable runs since the start of the year. It surged so much in the wake of the Iran airstrikes that it even drew the attention of the broadsheet financial press. So naturally, the price was bound to tank shortly afterwards. Which is precisely what happened this morning. If you’re a gold investor, you might be fretting that gold’s high point for 2020 has already come and gone. I wouldn’t worry.”