Bitcoin’s fantastic year – Great returns for investors

2019 has been a good year for the cryptocurrency market, with the price of many tokens increasing steadily in value throughout the year.

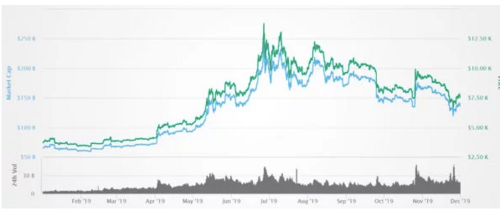

Bitcoin – the world’s largest cryptocurrency – was priced at $3,739 at the beginning of 2019, while as of 1 December, it had more than doubled in value and was back up to $7,570.

This is great news for investors who held on their cryptocurrency investment through volatile dips and rallies, as they would have seen a great return.

The price is nowhere near the historic highs the digital currency reached in late 2017, but it shows a steady rally in investor support despite its volatility.

The euphoria surrounding cryptocurrencies has long since faded compared to the market’s rally in 2017, but many fans and investors are growing interested in the potential applications of the technology.

Regulation also plays a role in the price of cryptocurrencies, as well as the potential applications of digital currencies – even centralised ones like Facebook’s Libra.

Below is an overview of Bitcoin’s price increase from 1 January – 1 December 2019.

Bitcoin price changes

1 January 2019 – $3,739

1 December 2019 – $7,570

Increase – 102%

.png)

What happened this year

The cryptocurrency market saw general growth this year, despite retaining its trademark volatility.

Luno Africa general manager Marius Reitz stated that this year’s blockchain-related headlines were dominated by Facebook’s announcement of Libra, its asset-backed stablecoin.

“With access to a massive user base, Libra has the potential to bring cryptocurrency into the mainstream,” Reitz said.

Another major moment was when the owners of the New York Stock Exchange launched Bakkt, a platform designed to push Bitcoin much deeper into mainstream adoption by offering physically settled Bitcoin futures contracts.

Other significant news including the increased attention given to digital currencies by regulators, as well as the formation of plans for central banks to develop their own cryptocurrencies.

“Cryptocurrencies are a new asset class, so there is a higher level of volatility compared with traditional trading,” Reitz said.

“This is further fuelled by the global political landscape including trade talks, elections and Brexit, as well as relatively low levels of liquidity and the use of the coins for speculation.”

“Despite volatility, the price of Bitcoin is more than 100% higher than it was a year ago and its price trajectory over time continues to rise,” he added.

“As cryptocurrency starts to be used for its core purpose of exchanging value and regulation is introduced, the price will become more stable.”

Jamie McKane19 December 2019

David – http://markethive.com/david-ogden