Precipitous 20% Bitcoin Price Plunge to $8,000 Caused by Traders Data

Bitcoin hasn’t had the past ten days. Since the Sunday before last, the price of the cryptocurrency has shed some 15%, leaving many traders stumped as to what in the world took place to send digital assets plummeting.

Cynics of the Bitcoin market have suggested that the rally to $14,000 and the subsequent dump was “one final pump and dump” enacted by whales. Gold proponent Peter Schiff, for instance, claimed that this move is a precursor to a plunge to $4,000, potentially lower.

But, data has shown that it isn’t these whales causing Bitcoin’s recent volatility, it’s the short-term traders presumably looking to make a quick buck.

Bitcoin Drop Led by Traders

Coinmetrics recently published to Twitter a chart that tracked the “change in the number of Bitcoin by price at time of last on-chain movement” for September 20th to 29th.

As seen below, the industry analytics startup found that during the recent price decline, “there was activity from Bitcoin that last moved when prices were between $13,000 and $20,000”, implying that capitulation for those in the red “is complete”.

There were other optimistic signs. Two, in fact.

Firstly, quite heavy selling from Bitcoin last moved in the $10,000 to $12,000 range hints that the sell-off was a byproduct of “short-term traders that have weak long-term conviction”.

And secondly, as there was little profit-taking from long-term holders that accumulated under $8,000, meaning that this subset’s “bull market psychology remains unchanged.”

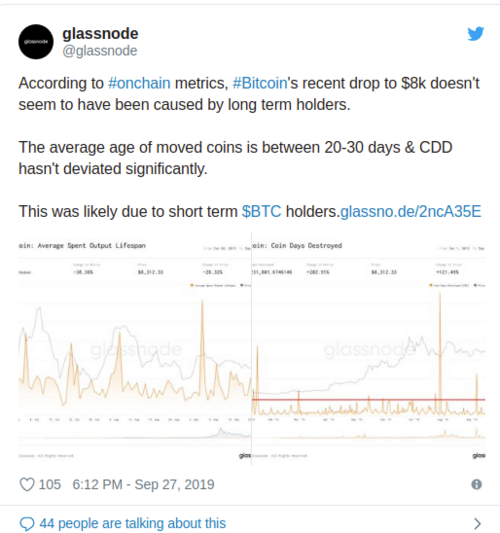

Cryptocurrency analytics firm Glassnode has corroborated this analysis. They found that the average age of moved coins over recent days “is between 20-30 days”, while the CoinDays Destroyed metric “hasn’t deviated significantly”.

This data can be interpreted as a sign that the “[price drop] was likely due to short-term holders,” which is partially proven by the massive volumes seen on BitMEX and other high time preference exchanges during this move lower.

Related Reading: Bitcoin Falls Below Stock-to-Flow Model, Will The Halving Be Front Run By Bulls?

The Accumulation Game

Short-term traders may have run for the hills, but HODLers, on the other hand, have been sticking to their guns.

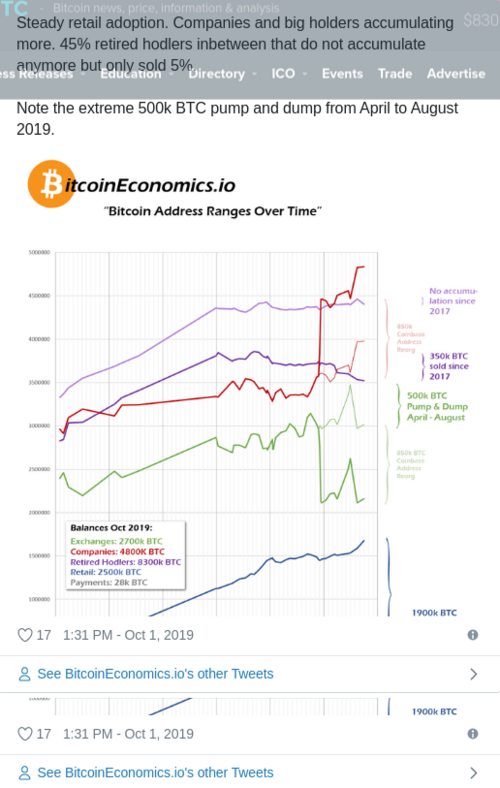

According to an analysis completed by Twitter account “BitcoinEconomics.io”, accumulation by addresses it deems “companies”, “retail holders”, and “big holders” has been on a steady uptrend, even throughout the recent bout of volatility. They claim that this is a sign that the “outlook for Bitcoin looks great”.

What all these investors seem to be waiting for is Bitcoin’s next block reward reduction — known as a “halving” or “halvening”. You see, in May 2020, the issuance (inflation) of BTC will be cut in half as a result of baked-in facets of the Bitcoin protocol. Analysts say that this halving event, which equates to a negative supply shock, will boost BTC to fresh heights.

Due to this potential for upside, or at least the hype surrounding this narrative, investors are believed to be stacking satoshis (as they fondly call the game of Bitcoin accumulation) in anticipation of price upside.

Whether or not that upside comes to fruition, however, remains to be seen. But many sure seem to be betting on it.

Nick Chong

David – http://markethive.com/david-ogden