Bitcoin (BTC) Price Near Inflection Point – Fresh Increase Likely

-

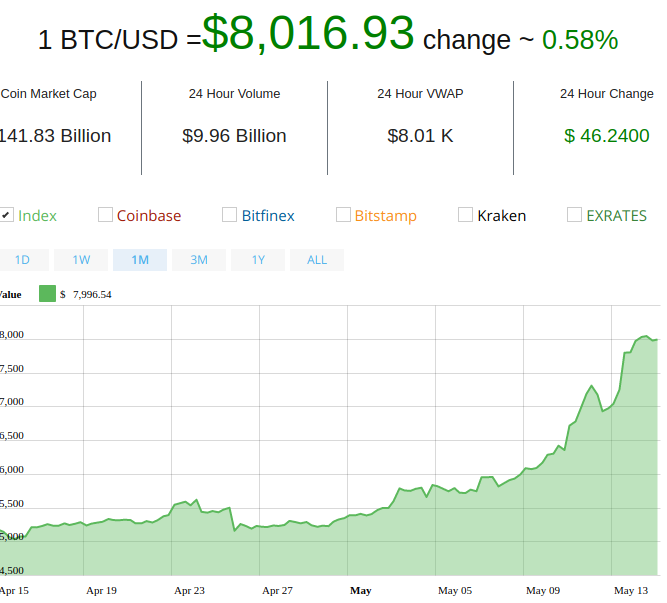

Bitcoin price declined heavily yesterday and traded close to the $6,650 support against the US Dollar.

-

The price traded as low as $6,645 and it is currently recovering towards the $7,400 level.

-

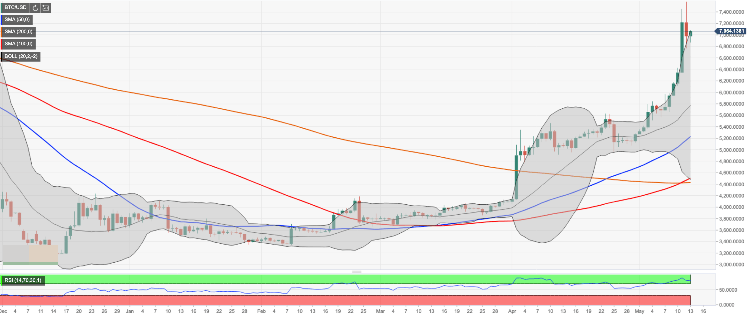

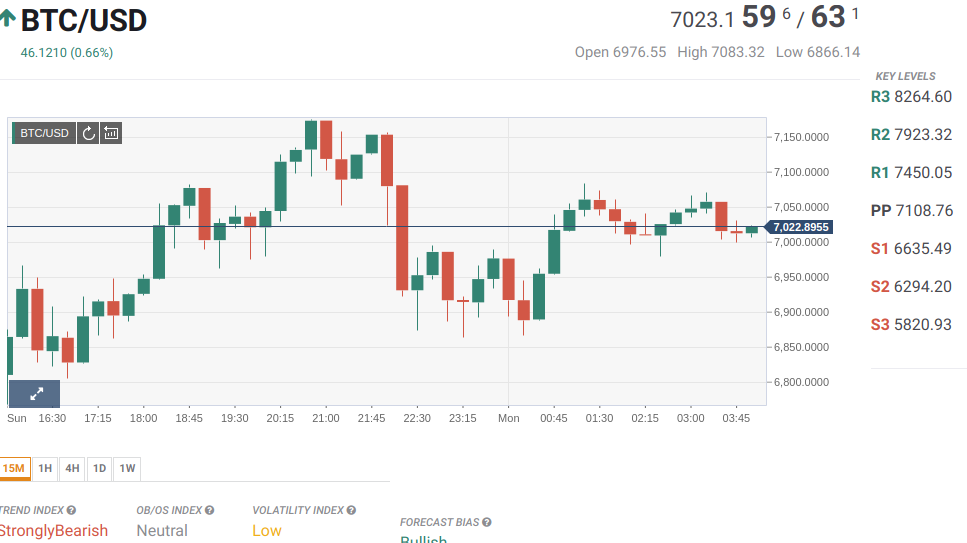

There is a key bearish trend line forming with resistance at $7,400 on the hourly chart of the BTC/USD pair (data feed from Kraken).

-

The pair needs to clear the $7,400 and $7,512 resistance levels to start a strong upward move.

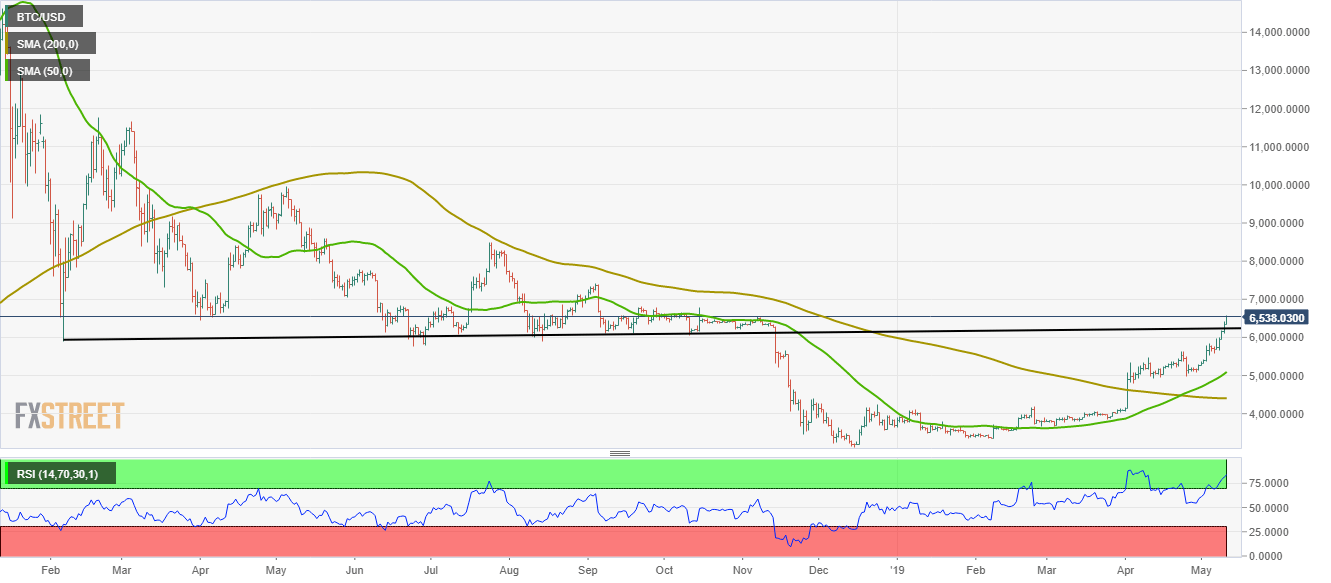

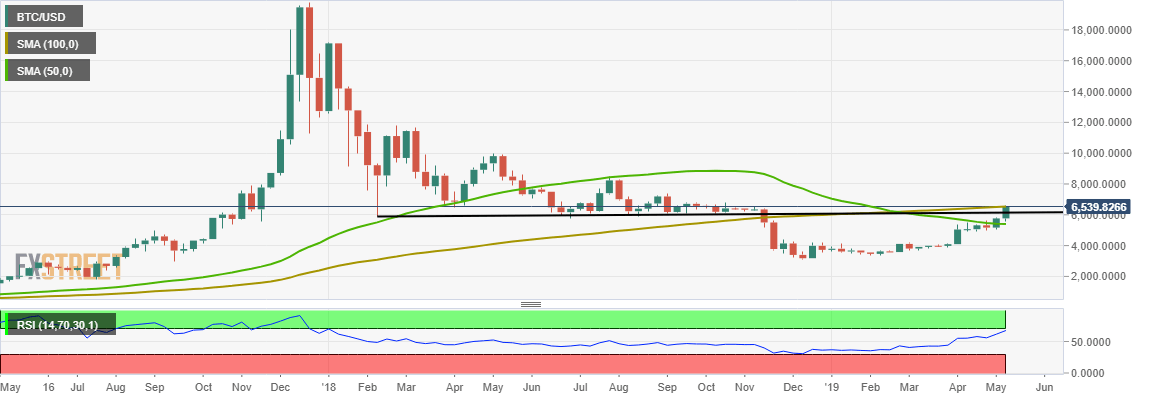

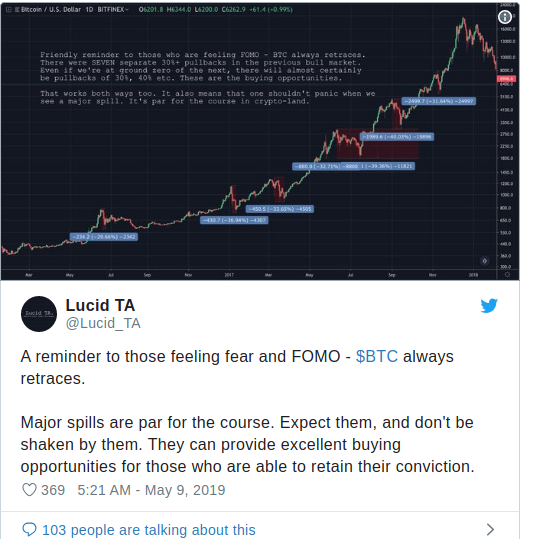

Bitcoin price seems to be forming a new support base above $7,000 against the US Dollar. BTC is likely forming a decent bottom and it could climb higher above $7,400 and $7,500.

Bitcoin Price Analysis

Yesterday, we saw a significant downside correction in bitcoin price below the $8,000 and $7,500 supports against the US Dollar. The BTC/USD pair declined heavily and even broke the $7,000 support and 100 hourly simple moving average. Finally, there was a spike towards the $6,650 support area, where buyers emerged. A swing low was formed at $6,645 and the price recently started an upside correction. It traded above the $7,000 and $7,050 resistance levels. Besides, there was a break above the 23.6% Fib retracement level of the recent decline from the $8,050 swing high to $6,645 low.

At the moment, the price is trading above $7,200, but it is facing a strong resistance near $7,400. There is also a key bearish trend line forming with resistance at $7,400 on the hourly chart of the BTC/USD pair. Moreover, the price is struggling near the 50% Fib retracement level of the recent decline from the $8,050 swing high to $6,645 low. If there is a proper break above the trend line and $7,420, the price could trade further higher.

An important hurdle is near the $7,512 level and the 61.8% Fib retracement level of the recent decline from the $8,050 swing high to $6,645 low. A successful follow through above $7,512 is likely to set the pace for more gains in the near term. The next key resistances are near the $7,720 and $7,800 levels. On the downside, an initial support is near the $7,200 level. If there are further declines, the price could retest the $7,000 support.

Looking at the chart, bitcoin price is currently trading with a positive bias above the $7,000 support. Therefore, there are high chances of a fresh increase above the $7,400 and $7,500 levels. Only a close below $7,000 could increase bearish pressure in the near term.

Technical indicators:

Hourly MACD – The MACD is back in the bullish zone, with a positive bias.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is moving higher and is currently above the 50 level.

Major Support Levels – $7,200 followed by $7,000.

Major Resistance Levels – $7,400, $7,512 and $7,720.

Aayush Jindal

1 min ago

David – http://markethive.com/david-ogden

t

t

![Bitcoin [BTC] Breaches $6000 - Time for a Pullback or Locking New Targets?](http://seriouswealth.net/wp/wp-content/uploads/2019/05/screenshot-coingape.com-2019.05.09-05-34-28.png)