Gold, silver near steady – new fundamental inputs awaited

Gold and silver prices are trading not far from unchanged in midday U.S. trading Tuesday. A big drop in the U.S. dollar index this week is limiting selling interest in the precious metals. However, rising U.S. Treasury bond yields this week and a wobbly crude oil market are squelching the bulls. A lack of fresh, markets-moving economic or geopolitical news in mid-summer has metals traders languishing and looking more at the outside markets for direction. August gold futures were last up $0.90 at $1,711.10. September Comex silver futures were last down $0.105 at $18.735 an ounce.

Global stock markets were mixed overnight. U.S. stock indexes are solidly higher at midday. Corporate earnings reports are on the front burner of the stock markets this week. Otherwise, its summertime doldrums trading amid a lack of major, fresh news this week.

In overnight news, the Euro zone consumer price index report for June came in at up 8.6%, year on year, which was right in line with market expectations.

Traders and investors are looking ahead to Thursday when the European Central Bank holds its regular monetary policy meeting. The ECB is expected to raise interest rates for the first time in 11 years, with many market watchers looking for a 0.5% rate increase. The U.S. Federal Reserve is expected to raise its key interest rate by at least 0.75% at next week’s FOMC meeting.

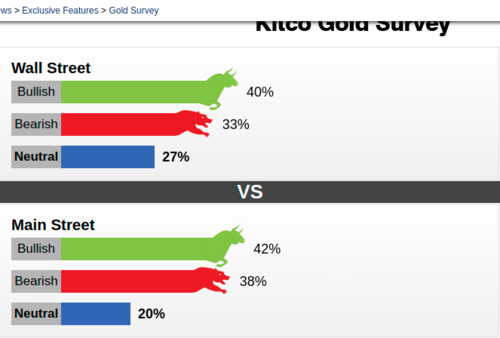

The gold market has turned bearish

The gold market has turned bearish

The key outside markets today see Nymex crude oil prices firmer and trading around $103.00 a barrel. The U.S. dollar index is solidly lower again today. The yield on the 10-year U.S. Treasury note is fetching 3.00%.

.gif)

Technically, August gold futures bears have the solid overall near-term technical advantage. Prices are in a four-month-old downtrend on the daily bar chart. Bulls' next upside price objective is to produce a close above solid resistance at $1,750.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,650.00. First resistance is seen at this week’s high of $1,722.00 and then at $1,735.00. First support is seen at the July low of $1,695.00 and then at $1,685.00. Wyckoff's Market Rating: 1.0.

.gif)

September silver futures bears have the solid overall near-term technical advantage. Silver bulls' next upside price objective is closing prices above solid technical resistance at $20.00 an ounce. The next downside price objective for the bears is closing prices below solid support at $17.50. First resistance is seen at $19.00 and then at $19.36. Next support is seen at today’s low of $18.51 and then at $18.00. Wyckoff's Market Rating: 1.5.

September N.Y. copper closed down 520 points at 329.30 cents today. Prices closed near mid-range today. The copper bears have the solid overall near-term technical advantage. A steep six-week-old price downtrend is in place on the daily bar chart. Copper bulls' next upside price objective is pushing and closing prices above solid technical resistance at 375.00 cents. The next downside price objective for the bears is closing prices below solid technical support at 315.00 cents. First resistance is seen at this week’s high of 337.10 cents and then at 340.00 cents. First support is seen at 325.00 cents and then at the July low of 313.15 cents. Wyckoff's Market Rating: 1.5.

By Jim Wyckoff

For Kitco News

Time to buy Gold and Silver on the dips

David – http://markethive.com/david-ogden

.gif)

.gif)

Gold hammered, analysts warn of capitulation event if price drops below pre-pandemic levels

Gold hammered, analysts warn of capitulation event if price drops below pre-pandemic levels.gif)

.gif)

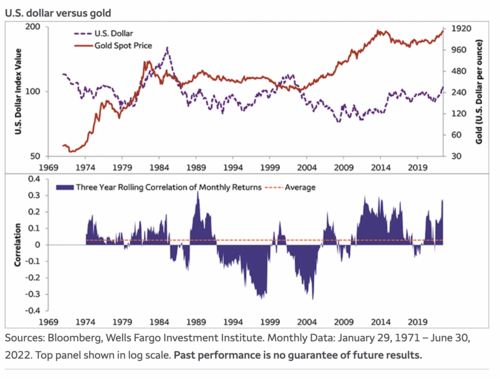

This is why gold is below $1,800 even as U.S. inflation hits a 40-year high at 9.1%

This is why gold is below $1,800 even as U.S. inflation hits a 40-year high at 9.1%

Gold faces a difficult second half but it's not hopeless – World Gold Council

Gold faces a difficult second half but it's not hopeless – World Gold Council