Gold posts solid gains for the week as market participants focus on the economy

Gold prices closed higher on the day and the week resulting in solid gains. As of 5:50 PM, ET gold futures basis most active June contract is currently up $3.90 or 0.21% fixed at $1845.10. Considering that gold futures traded to a low this week of $1785 and closed near the highest value this week of $1848.60 gold had a good week.

Gold pricing had been under pressure for the fourth consecutive week before this week’s trading activity resulting in defined technical chart damage with gold breaking below its 200-day moving average last Thursday, May 12. This week’s low occurred on Monday, May 16 when gold prices hit a low of $1785, and traded to a high of $1825 before closing above its opening price on Monday and above Friday’s closing price at $1813.60. On Tuesday gold traded to a higher high and a higher low than Monday, even though gold closed fractionally lower than its opening price. On Wednesday gold traded to a lower low and a lower high than Tuesday’s price action but that all changed on Thursday.

Thursday’s price action moved gold solidly higher opening at $1816 and closing at $1841, above its 200-day moving average of $1837. Although today gold had only a small gain it opened and closed above its 200-day moving average which on a technical basis is significant. If gold can maintain pricing above $1837 on a technical basis, we can derive that gold prices are now back in a solid long-term bullish demeanor.

The recovery in gold this week was based upon market sentiment shifting their attention from the recent and future activities of the Federal Reserve in regards to their tightening monetary policy in which they have raised the Fed funds rate by ½ a percent at this month’s FOMC meeting which follows the quarter-percent rate hike they enacted in March. Recent statements by Chairman Powell indicated that they will get more aggressive when he said that he is open to raising rates well above the Federal Reserve’s interest rate target for normalization which is been set at approximately 2%. This was interpreted as a more aggressive monetary policy in an attempt to stop inflation from spiraling higher.

Statements from the Federal Reserve before this week were indicating that they believe that inflationary pressures had peaked and using the most recent numbers from last month’s CPI inflation index is the validation of that assumption. The CPI index came in at 8.3% for April, below the 8.5% rate that occurred in March.

It has been the tightening of the Federal Reserve’s monetary policy which has resulted in a tremendous selloff in U.S. equities which continue through this week taking all three major indices into a defined tailspin with seven consecutive weeks of price declines.

However, gold had been selling off for the last four consecutive trading weeks based upon anticipation of much higher interest rates to stave off inflation. However, this week we have seen a clear and defined reversal of market sentiment as investors are now clearly focused on the reality that inflation has not peaked and is most likely continuing to move higher and the prolonged risk-off market sentiment has shifted market sentiment from the higher yields of U.S. Treasuries to the safe-haven asset; gold

By Gary Wagner

Contributing to kitco.com

Time to buy Gold and Silver on the dips

David – http://markethive.com/david-ogden

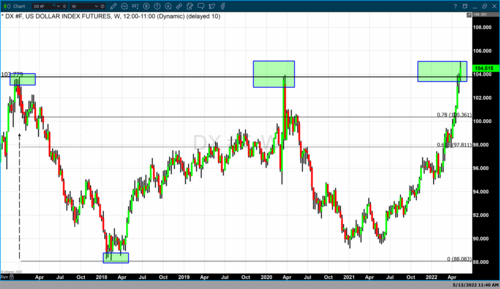

U.S. dollar will keep gold price under pressure – VanEcK's Foster and Casanova

U.S. dollar will keep gold price under pressure – VanEcK's Foster and Casanova.gif)

.gif)

2022's $1 trillion crypto wipeout: 'necessary cleansing' of excess speculation just like dot-com bubble – Bloomberg Intelligence

2022's $1 trillion crypto wipeout: 'necessary cleansing' of excess speculation just like dot-com bubble – Bloomberg Intelligence.gif)

.gif)

.gif) Gold faces new competition as real yields turn positive – USBWM

Gold faces new competition as real yields turn positive – USBWM.gif)

.gif)

.jpg) U.S. dollar could dominate gold price through the summer – analysts

U.S. dollar could dominate gold price through the summer – analysts.gif)

.gif)

.jpg) Gold price is manipulated by the Fed, suspects mining tycoon Frank Giustra, but suppression can't last forever

Gold price is manipulated by the Fed, suspects mining tycoon Frank Giustra, but suppression can't last forever

Nothing can fix inflation now, 'economic stupidity' is underway by the Fed, Biden – Steve Hanke

Nothing can fix inflation now, 'economic stupidity' is underway by the Fed, Biden – Steve Hanke.gif)

.gif)

Gold price is manipulated by the Fed, suspects mining tycoon Frank Giustra, but suppression can't last forever

Gold price is manipulated by the Fed, suspects mining tycoon Frank Giustra, but suppression can't last forever