'Bears are in control' of gold price: will next week's Fed announcement be a shocker?

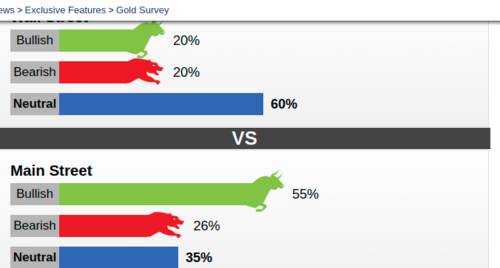

After falling $40 this week, gold bears are in control of the market with all eyes on what could be a hawkish Federal Reserve meeting next week, according to analysts.

Gold dropped to four-week lows on Thursday, falling from above $1,790 an ounce to $1,750 an ounce after much stronger U.S. retail numbers. This is big news ahead of the Fed's interest rate announcement on Wednesday because it could mean tapering sooner rather than later.

"Bears have control now. We had a complete flip in retail sales. This reinforces the idea that the Fed's hand is being forced to taper," RJO Futures senior market strategist Frank Cholly told Kitco News. "Right now, gold is in a new trading range. The short-term trend is down."

If the U.S. economic data continues to surprise on the upside, gold could be in store for another selloff. "We see yields starting to pick up, and the U.S. dollar is strong. This puts pressure on gold. We could see $1,720 next week. I don't think it will be hard to take another $30 out of the market," Cholly said.

Another problem for gold at the moment is the lack of interest from new buyers, said TD Securities head of global strategy Bart Melek.

"Traders are prepared to sell on any sort of suggestion that economic activity is better than expected because that gets them to believe the Fed will have no hesitancy to start tapering," Melek said.

Gold has also ignored its usual drivers and instead focused on macro data, noted Gainesville Coins precious metals expert Everett Millman.

"Gold is comfortable between $1,700-$1,800 an ounce range. Unless we get surprising data, I don't expect the precious metal to have an outrageous swing one way or the other," Millman told Kitco News. "The $1,740 level is support, and resistance is at $1,770-$1,800."

What to expect from the Fed

The focus is now on the Fed's statement on Wednesday, with markets paying close attention to any detail on the timing of bond-purchase tapping, said Millman. "The Fed has set the groundwork, and everyone is aware that tapping will happen soon. The central bank doesn't have to move on that at least until December," he said.

Going forward, the U.S. central bank will pay close attention to the U.S. inflation and employment data when updating the market on its future tapering plans.

"If the Fed does nothing on Wednesday but signals that it has a plan and will do something in December, that will be slightly good for gold. The gold market does want to see rates remain low," Millman added.

God is unlikely to fall much lower even if the Fed does announce something, Melek pointed out.

"I don't think we are at huge selloff risk here. There is still a belief that rates aren't really going up higher. We have a central bank in the U.S. that is focused on full employment and telling us that inflation is not a huge concern. To me, it suggests that taper is going to happen, but it won't be overly aggressive," he said. "Gazing into the FOMC meeting next week, we could see fairly strong hints. On the downside, $1,740 is still pretty decent support. We might cross over into the $1,730 level. But I don't see an outright rout."

The Fed will also be releasing its updated economic forecasts and the dot plot.

"New forecasts will show a slight growth downward revision with an upward inflation revision. The big story could be the Fed individual dot forecasts for interest rate increases. Currently, 7 out of 18 officials are going for 2022 as the starting point for increases, and we could conceivably see one or two more bring their forecast forward to 2022. We suspect the median stays at 2023 for now, but it will be a close call," said ING chief international economist James Knightley.

Data to watch

Other data to watch next week include Tuesday's building permits and housing starts, Wednesday's existing home sales, Thursday's Bank of England interest rate announcement and U.S. jobless claims, as well as Friday's new home sales.

On top of that, Fed Chair Jerome Powell will provide opening remarks at Friday's virtual Fed Listens event titled 'Perspectives on the Pandemic Recovery.'

Canada also goes to the polls on Monday after Prime Minister Justin Trudeau called a snap election in order to try to get a majority government

"Things do not appear to be going to plan with Trudeau's Liberal Party now neck-and-neck in opinion polls with the opposition Conservatives. This means that the New Democratic Party could hold the balance of power, which would imply a higher chance of increased taxes and spending," Knightley pointed out.

By Anna Golubova

For Kitco News

Trade Gold and Silver with secure storage at no cost

David – http://markethive.com/david-ogden

.gif)

.gif)

.png)