Bitcoin (BTC) Price Weekly Forecast: $10K Holds Key For Recovery

There was a major downward move below the $10,000 support in bitcoin price against the US Dollar.

The price is currently correcting higher, but upsides remain capped near $9,800 and $10,000.

There is a major bearish trend line forming with resistance near $9,980 on the 4-hours chart of the BTC/USD pair (data feed from Kraken).

There could be a short term upside correction, but the bulls are likely to struggle near $10,000.

Bitcoin price is facing a lot of hurdles on the upside near $10,000 against the US Dollar. BTC remains sell on rallies as long as it is trading below the $10,000 resistance.

Bitcoin Price Weekly Analysis (BTC)

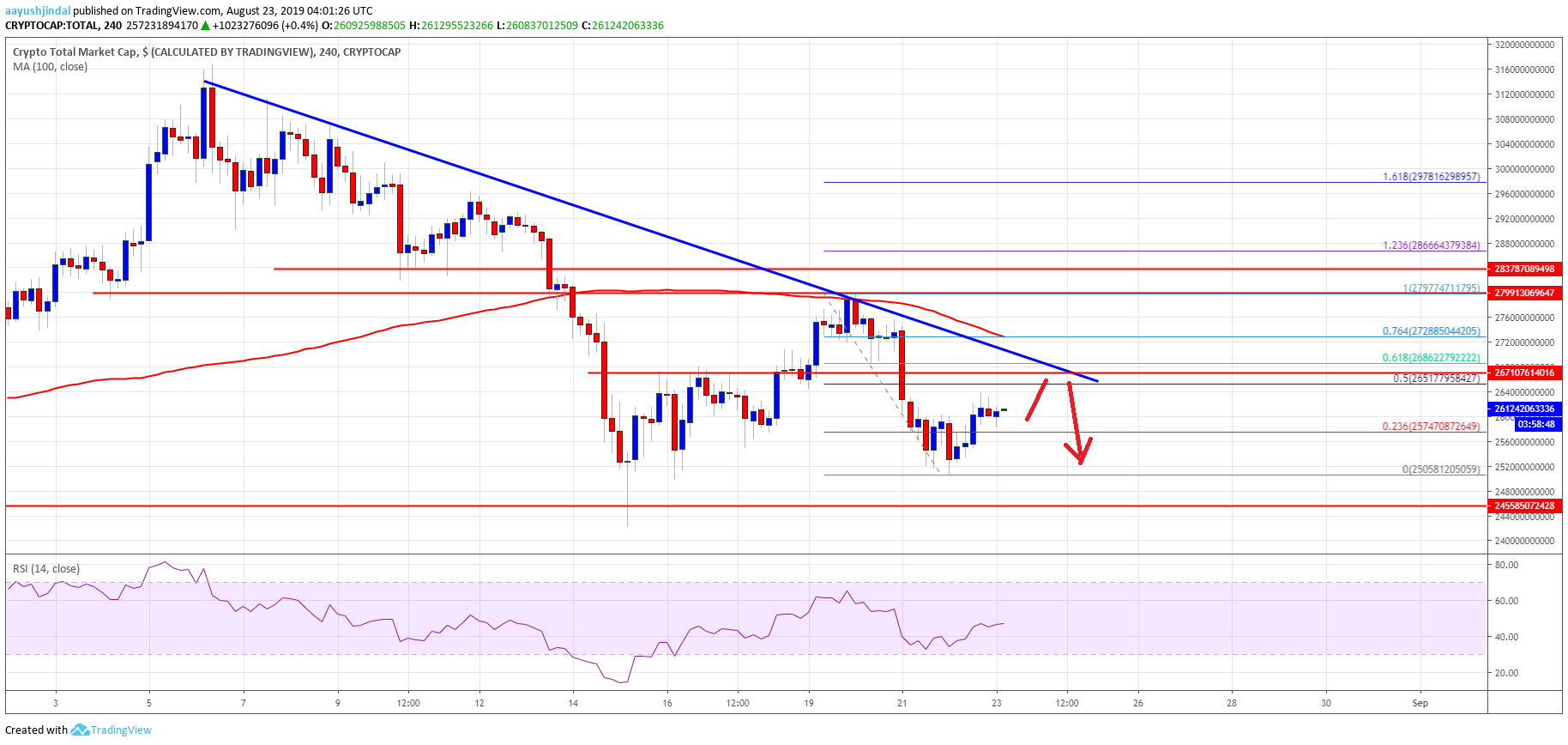

In the last weekly forecast, we discussed the possibilities of a downward move below $10,000 in bitcoin price against the US Dollar. The BTC/USD pair did move down and broke the key $10,000 and $9,800 support levels. Moreover, there was a close below the $10,000 pivot and the 100 simple moving average (4-hours). Finally, there was a break below the $9,800 and $9,500 supports as well.

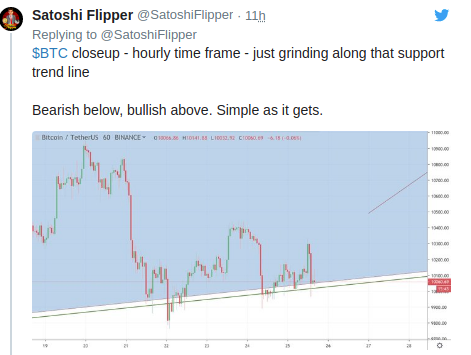

A new monthly low was formed near $9,300 and the price is currently consolidating losses. It is testing the 23.6% Fib retracement level of the recent decline from the $10,717 high to $9,308 low. However, there are many hurdles on the upside near the $9,800 and $9,900 levels. Additionally, there is a major bearish trend line forming with resistance near $9,980 on the 4-hours chart of the BTC/USD pair.

Moreover, the 50% Fib retracement level of the recent decline from the $10,717 high to $9,308 low is also near the $10,010 level. Therefore, upsides are likely to remain capped near the $9,800 and $10,000 levels. Above the trend line, the 100 SMA is waiting near the $10,150 level. The 61.8% Fib retracement level of the recent decline from the $10,717 high to $9,308 low is also waiting near the $10,170 level.

On the downside, an immediate support is near the $9,500 level. If there is a downside break below the $9,500 support, the price may continue to move down below the last swing low at $9,300. The next key supports are near the $9,100 and $9,000 levels.

Looking at the chart, bitcoin price is clearly trading in a downtrend below $10,000. In the short term, there could be an upside correction, but the $9,800 and $10,000 levels are likely to act as major sell zones in the coming sessions.

Technical indicators

4 hours MACD – The MACD for BTC/USD is slowly moving into the bullish zone.

4 hours RSI (Relative Strength Index) – The RSI for BTC/USD is slowly rising towards the 50 level.

Major Support Level – $9,500

Major Resistance Level – $10,000

Aayush Jindal

David – http://markethive.com/david-ogden