Bitcoin, Ethereum, Ripple, Monero Prices Surge–Is The Train Leaving The Station Again

Shaking off a host of negative news, major cryptocurrencies like Bitcoin, Ethereum, Ripple and Monero continued to surge recently. Bitcoin is up 2.05% over the last 24 hours and 17.53% over the last seven days, Ethereum is up 1.95% and 21.74% over the same periods, while Ripple and Monero registered even higher gains—see table 1.

Table 1

7d Price Change For Major Cryptocurrencies

Cryptocurrency %24h %7d

Bitcoin 2.05 17.53

Ethereum 1.95 21.74

Ripple 5.47 37.56

Monero 14.45 35.84

Source: Coinmarketcap.com 4/18/18 at 4:30 p.m.

The cryptocurrency rally comes as markets shake off a host of negative news ranging from regulators cranking down on cryptocurrency exchanges to large Bitcoin sales by major investors, and tax sell-offs, and extends across the entire chain, with 96 out of the top 100 cryptocurrencies advancing—see table 2.

Table 2

Number of Cryptocurrencies That Advanced/Declined In The Top 100 Ranks

Cryptocurrencies Advance/Decline Number

Advance 96

Decline 4

Source: Coinmarketcap.com 4/18/18 at 4:30 a.m.

Does this mean that the cryptocurrency train is leaving the station?

Todd Rowan, President and CEO of Rewardstoken.io, thinks so.“Bitcoin is the current engine pulling the crypto train,” said Rowan.“It seems to have found traction post-tax season selloffs; this is good for everyone. Ethereum is finding strong support along with Ripple and others. Next week will tell us if we are leaving the station. We could be off for another bull run.”

Ben WayCEO of Digits.io also thinks so. For ICO’s with real value, that is. “The train has definitely left the station for entrepreneurs trying to do an ICO on the back of a napkin,” he says. “However just like the shakeout in the dot-com bust, the ICO's with real value and real technology and concepts will be in good shape…..this happens in almost every market at some point, next we will see the same in AI and Robotics.”

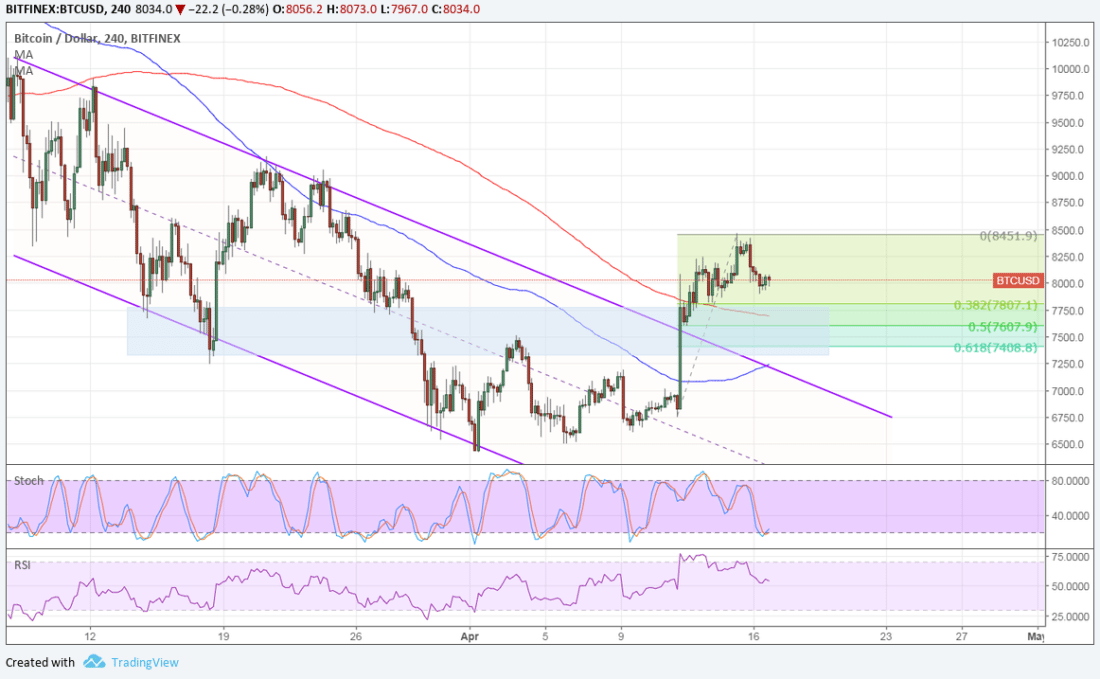

Michael Collins, Founder and CEO of GN Compass, is bullish on Bitcoin and Cardano. “After a four-month bear, there are now strong indications that we are heading towards a bull,” he notes. “Bitcoin dropping to about $6600 on the 5th of this month was probably the bottom for the year, its price will continue to climb and will probably hit a peak of $15,000 this year. Other coins are following suit with Cardano being the most impressive so far.”

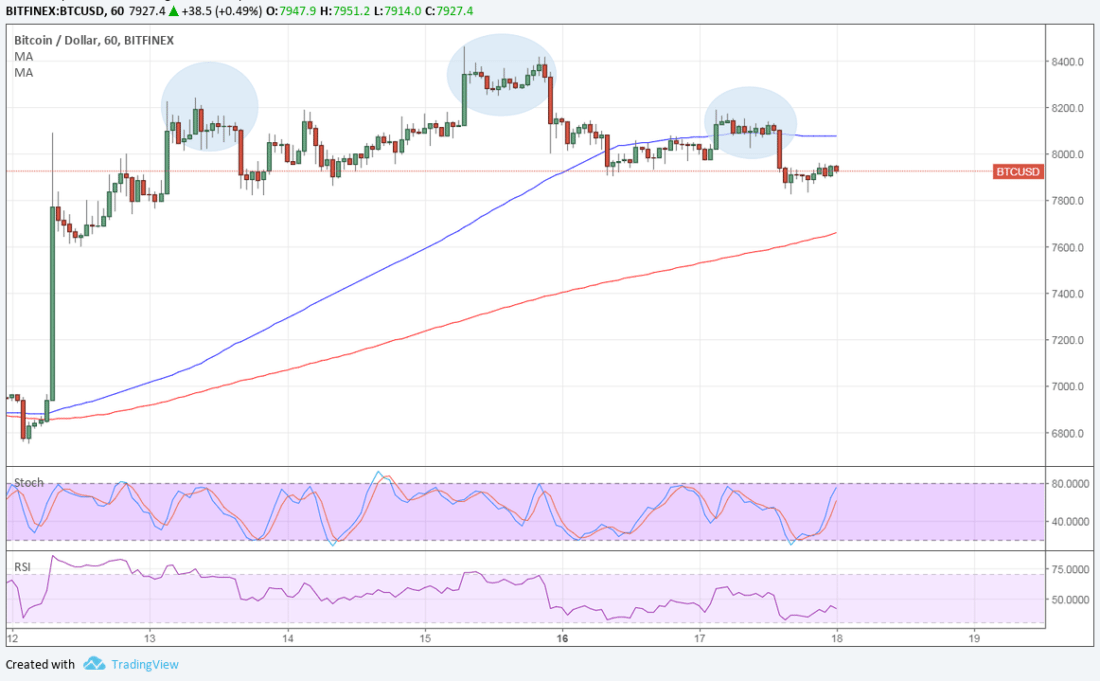

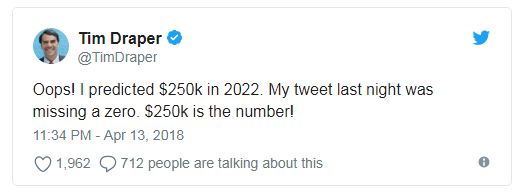

And Roman Guelfi-GibbsCEO, Lead Systems DesignerPinnacle Brilliance Systems Inc. thinks that investors have little time to get aboard the cryptocurrency train. “Investors have some time to make up their minds before the train leaves the station, but they will have to decide soon,” hesays. Guelfi-Gibbs sees Bitcoin heading to 10k, once crossing the $8500 mark.

What about Ethereum? “Ethereum has been recovering nicely over the past two weeks and was able to surmount the $500 hurdle,” notes Guelfi-Gibbs. “Whereas Bitcoin has been subject to some while swings, Ethereum has been moving steadily upward. I would expect that trend to continue after a brief pullback to support.”

Panos Mourdoukoutas , CONTRIBUTOR

Posted by David Ogden Cryptocurrency Entrepreneur

David – http://markethive.com/david-ogden