Bitcoin, Ethereum, Bitcoin Cash, Ripple, IOTA, Litecoin, Dash, Monero: Price Analysis, Dec. 30

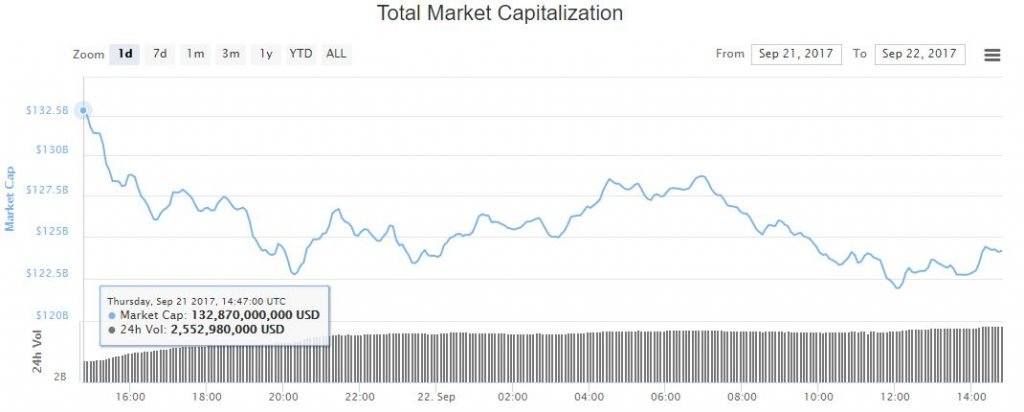

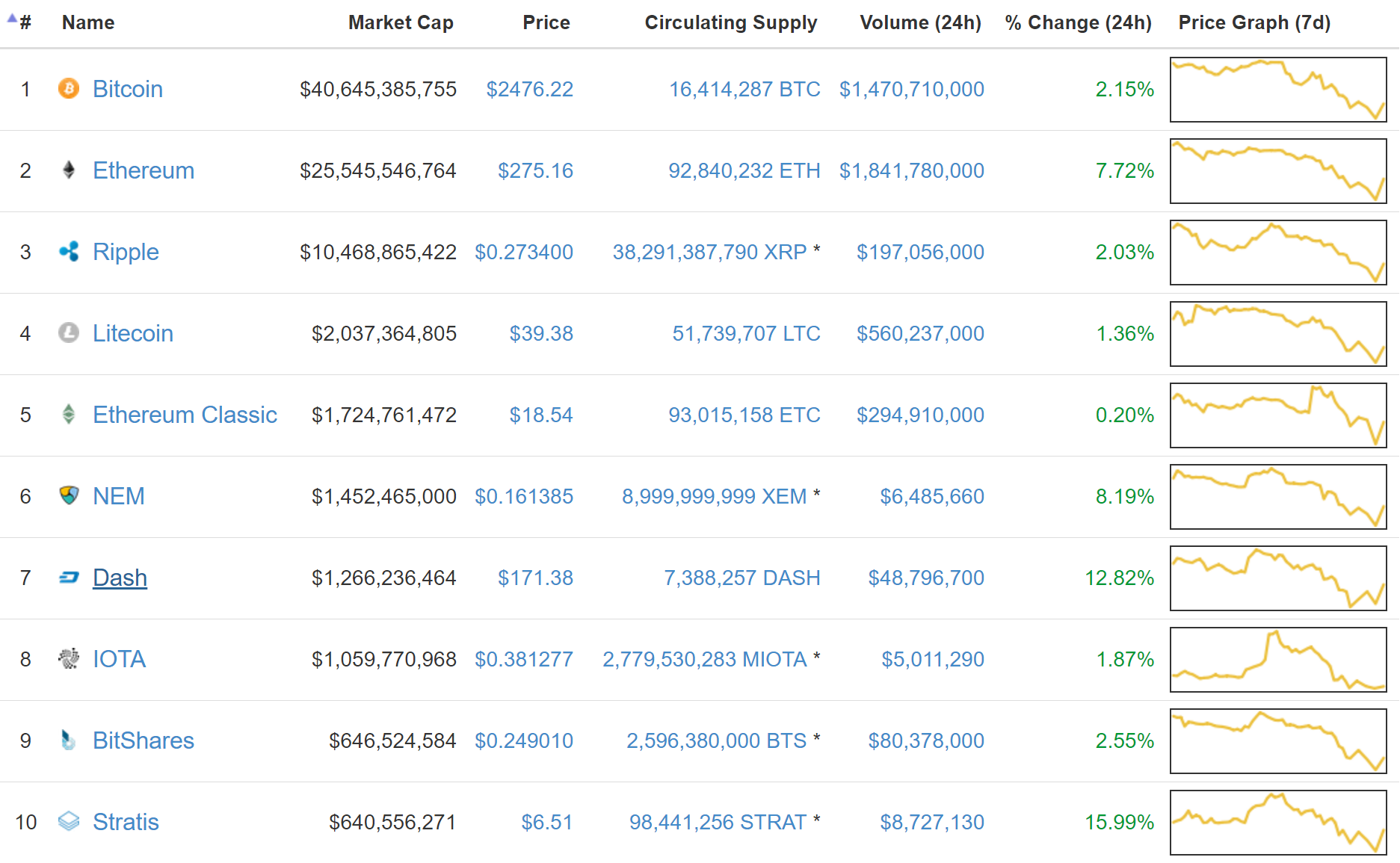

Cryptocurrencies have generated wealth for the traders like no other asset class. While Bitcoin has garnered most of the attention, it is not the only one to have risen in 2017. There have been scores of winners.

Ethereum was the second leading currencies aiming to overtake Bitcoin as the dominant leader of the year; it could never really achieve the feat.

However, within the past two weeks, Ripple has skyrocketed from a low of $0.22 on Dec. 10, to a high of $2.47 today. That’s a whopping rally of 1024 percent within a span of 20 days.

As a result, Ripple has now overtaken Ethereum as the second most valuable currency by market capitalization.

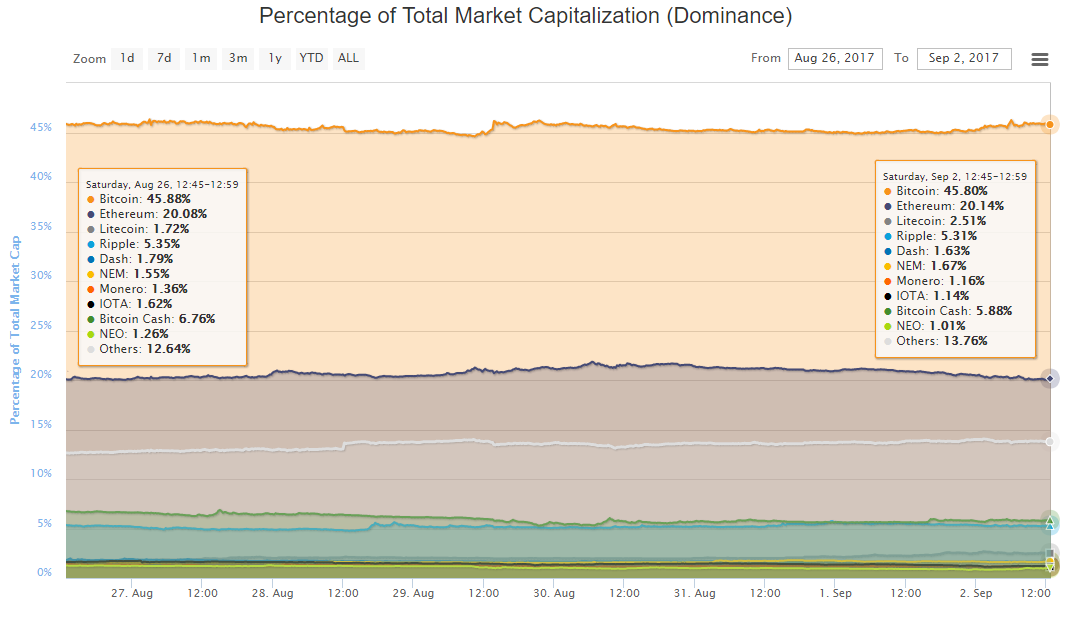

Bitcoin’s dominance, which had risen above 60 percent just a few weeks back has again cooled off to 38.3 percent.

As the market matures, we are likely to see a number of changes in the rankings of these currencies. Therefore, one has to keep an open mind towards all the cryptocurrencies because as traders; our main goal is to earn money.

So, do we have any good buy setups for the end of the year or is it best to remain on the sidelines and enjoy the holidays, returning to trade in the new year? Let’s find out.

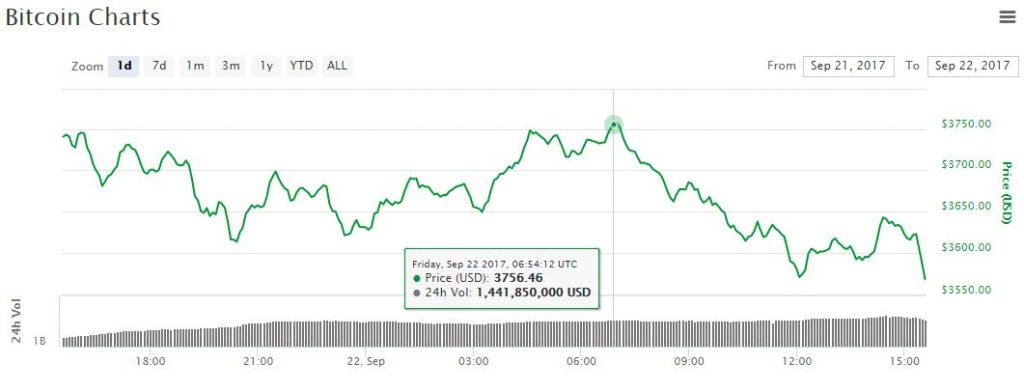

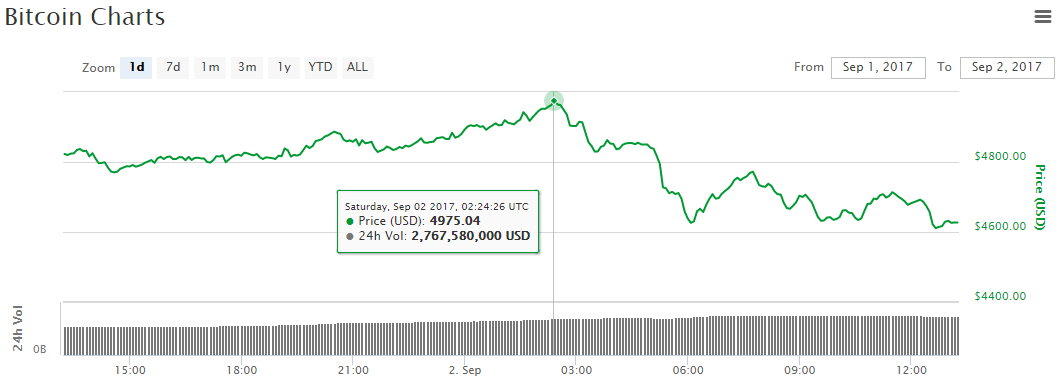

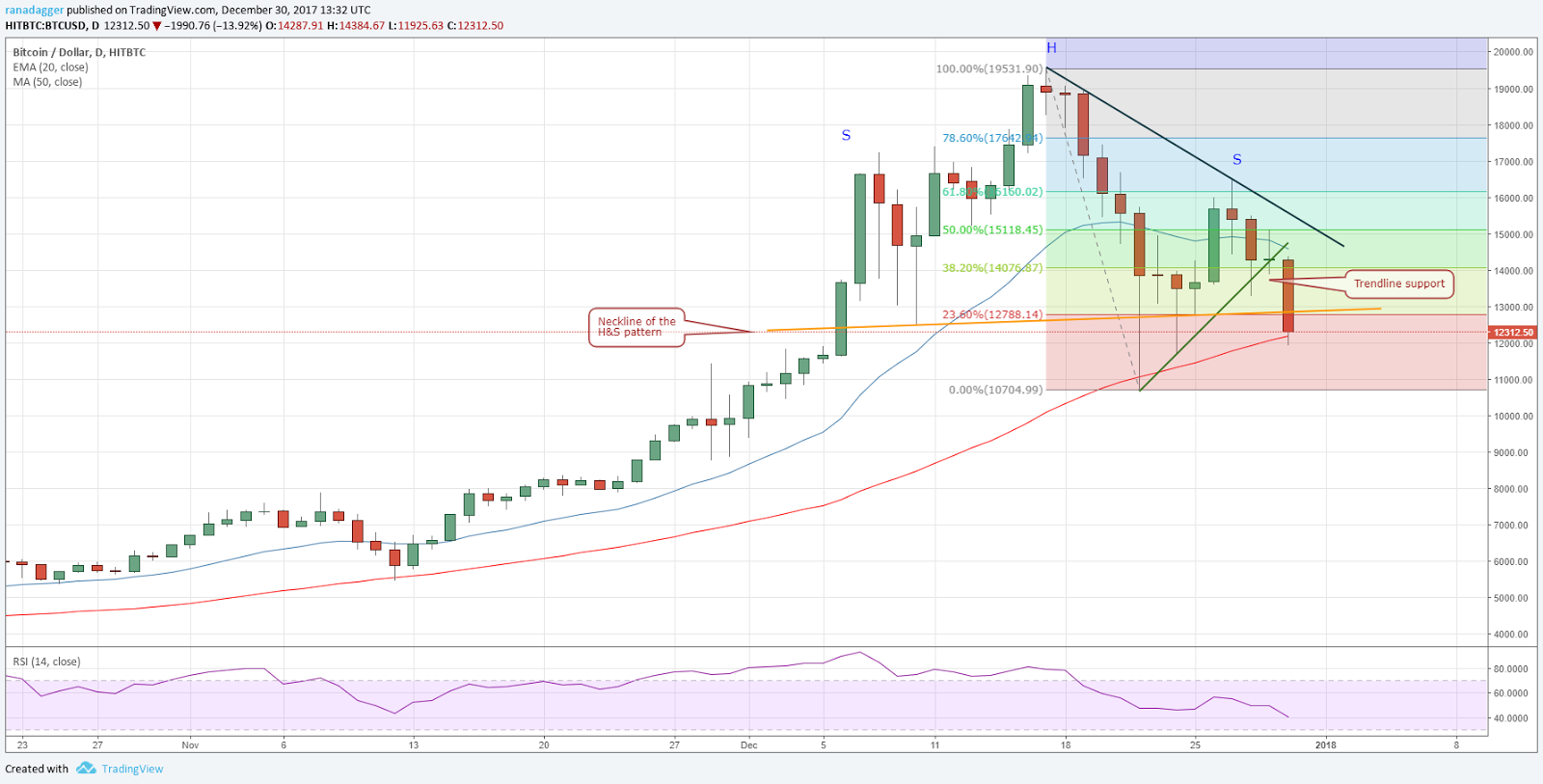

BTC/USD

We expected a pullback from the trendline, however, due to lack of buyers, the recovery never gained strength. Today, the bears easily broke below the trendline support, which has escalated the selling.

Bitcoin has broken down of the neckline of the bearish head and shoulders pattern. If the cryptocurrency sustains below the neckline, it has a pattern target of $5,745.

However, we don’t expect to see such a plunge in the short-term.

We believe that the bulls will attempt to defend the recent lows of $10,704.99. But if they fail, the bears are likely to intensify their selling. A number of long positions will start to bleed, which is likely to lead to panic selling. We see another support at the $8,000 mark.

All these lower levels will come into play only if the BTC/USD pair breaks and sustains below the 50-day SMA.

Contrarily, if the bears are unable to breakdown of the 50-day SMA, we may see a recovery in the new year. Yet, we will prefer to wait until the digital currency breaks out of the downtrend line to initiate any position. We don’t find any trades at the current price.

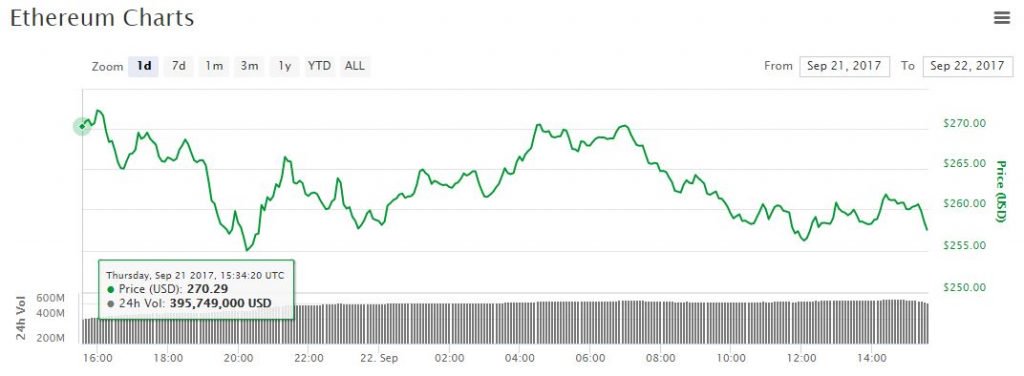

ETH/USD

We mentioned that Ethereum will become positive in the short-term only on a breakout and close above the downtrend line. Yesterday, the bulls broke out of the trendline but could not manage a close above it.

On the downside, the 20-day EMA has been providing a strong support. If this support level breaks, we may see a slide towards $646.08 and thereafter to $600 levels. On the other hand, the ETH/USD pair will become positive above $770 because it has returned from the $760 levels on three occasions.

Between the 20-day EMA and $760, we are likely to witness a volatile range-bound trading action.

Therefore, we suggest waiting until we get a clear breakout and a confirmation of the resumption of the uptrend.

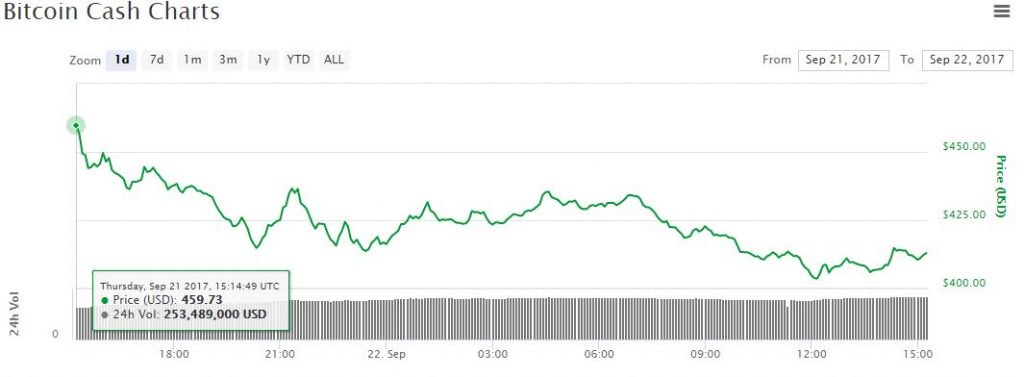

BCH/USD

For the past two days, the bulls had been defending the $2300 mark. But their attempt to resume the rally failed yesterday.

Today, the bears have broken down of the critical support level of $2300. The next downside target on the BCH/USD pair is a fall to the 50-day SMA.

We expect a strong buying around the $1,733 levels. Nonetheless, we recommend waiting until there is a clear bottom in sight.

Consider avoiding buying in a falling market.

XRP/USD

Ripple roared past our initial target objective of $1.5. Today, it reached an intraday high of $2.474.

Traders who had purchased on our bullish prediction should close their positions or at least trail with a close stop loss depending on their strategy.

After such a stellar rally, we expect the XRP/USD pair to enter into a correction or a consolidation. Therefore, we don’t have any fresh buy recommendations on it.

IOTA/USD

The bulls have successfully held on to the lower end of the range at $3.032 for the past few days. However, they have not been able to push the cryptocurrency higher.

Today, the IOTA/USD pair is again under a bear attack, which is threatening to break below the critical support. If the bears succeed, the cryptocurrency will fall to the 61.8 percent Fibonacci retracement level of $2.62196.

Yet, if the bulls manage to hold the supports once again today, IOTA will continue to trade inside the range. We shall initiate buy positions only on a breakout and close above the downtrend line. Until then, we shall remain on the sidelines.

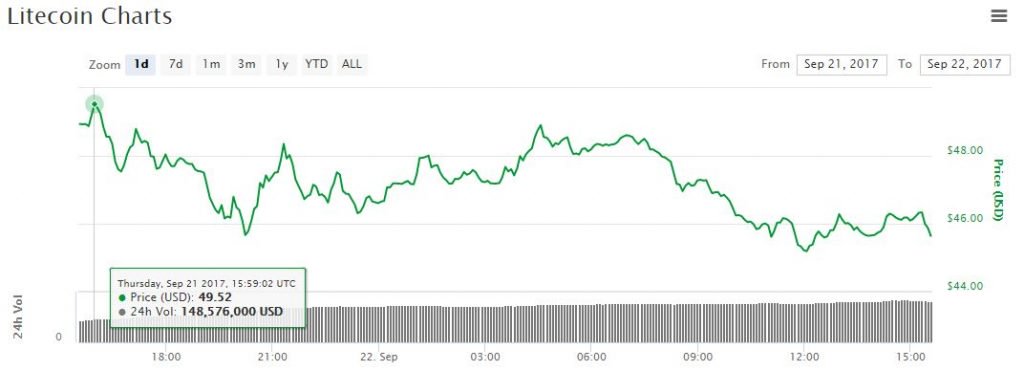

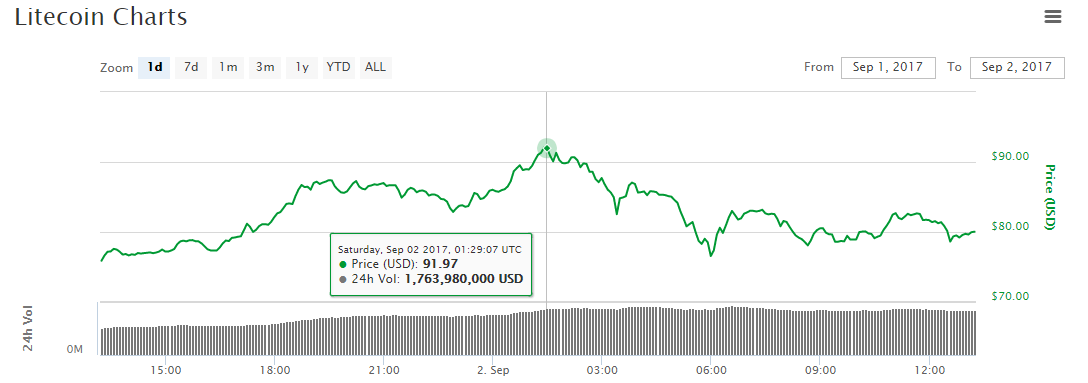

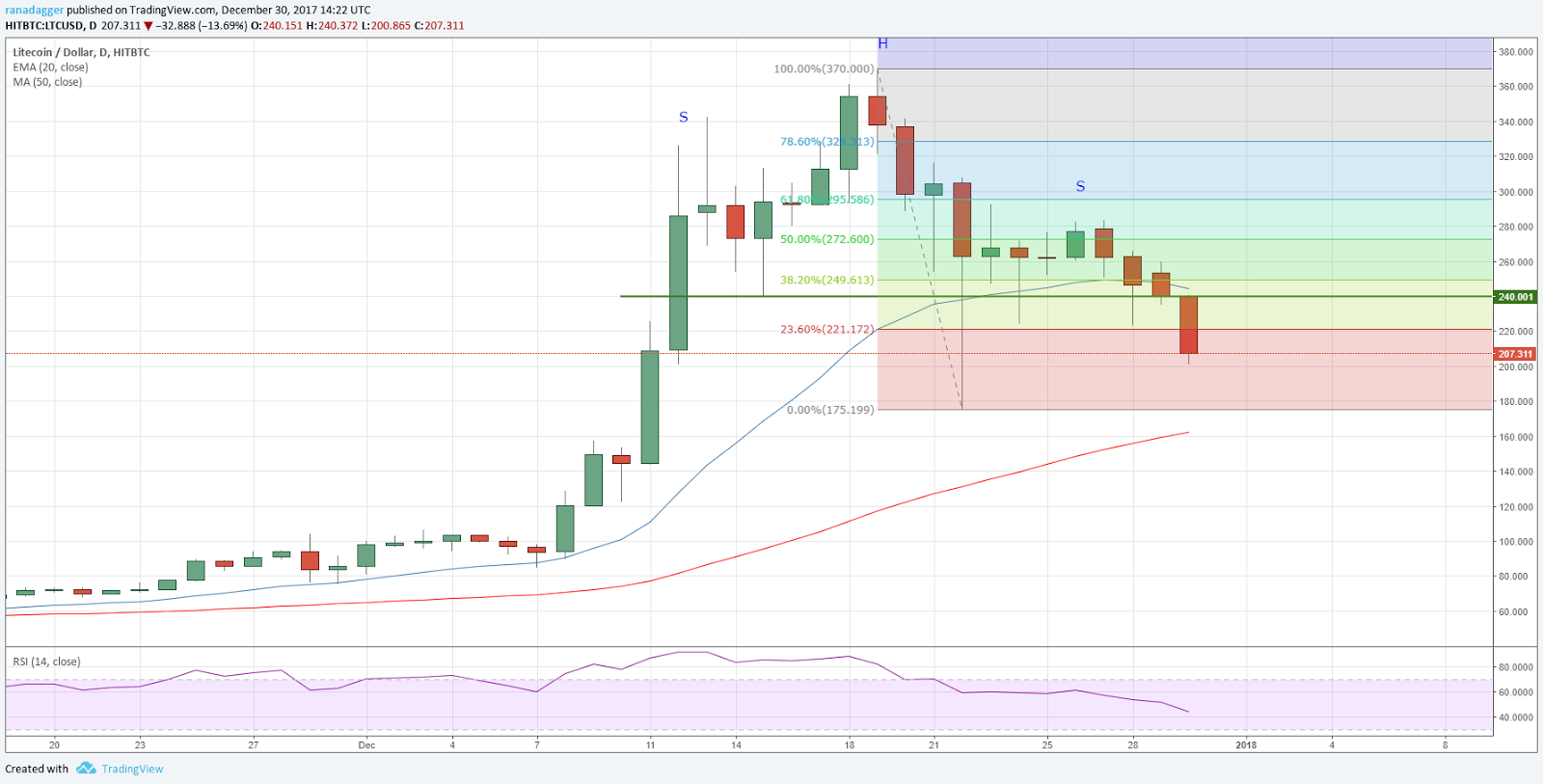

LTC/USD

The bears have broken below the neckline of the head and shoulders pattern. Unless the bulls stage takes a sharp recovery today, chances are that Litecoin will continue lower in the next few days.

We anticipate a strong support at the recent lows of $175.199. The 50-day SMA is also just below this level, which should also provide some support.

However, if both these levels fail to hold, the LTC/USD pair will fall towards $110, which is the target objective of the breakdown of the head and shoulders pattern.

Our bearish view will be invalidated if the bulls manage to push the digital currency above the neckline at $240.

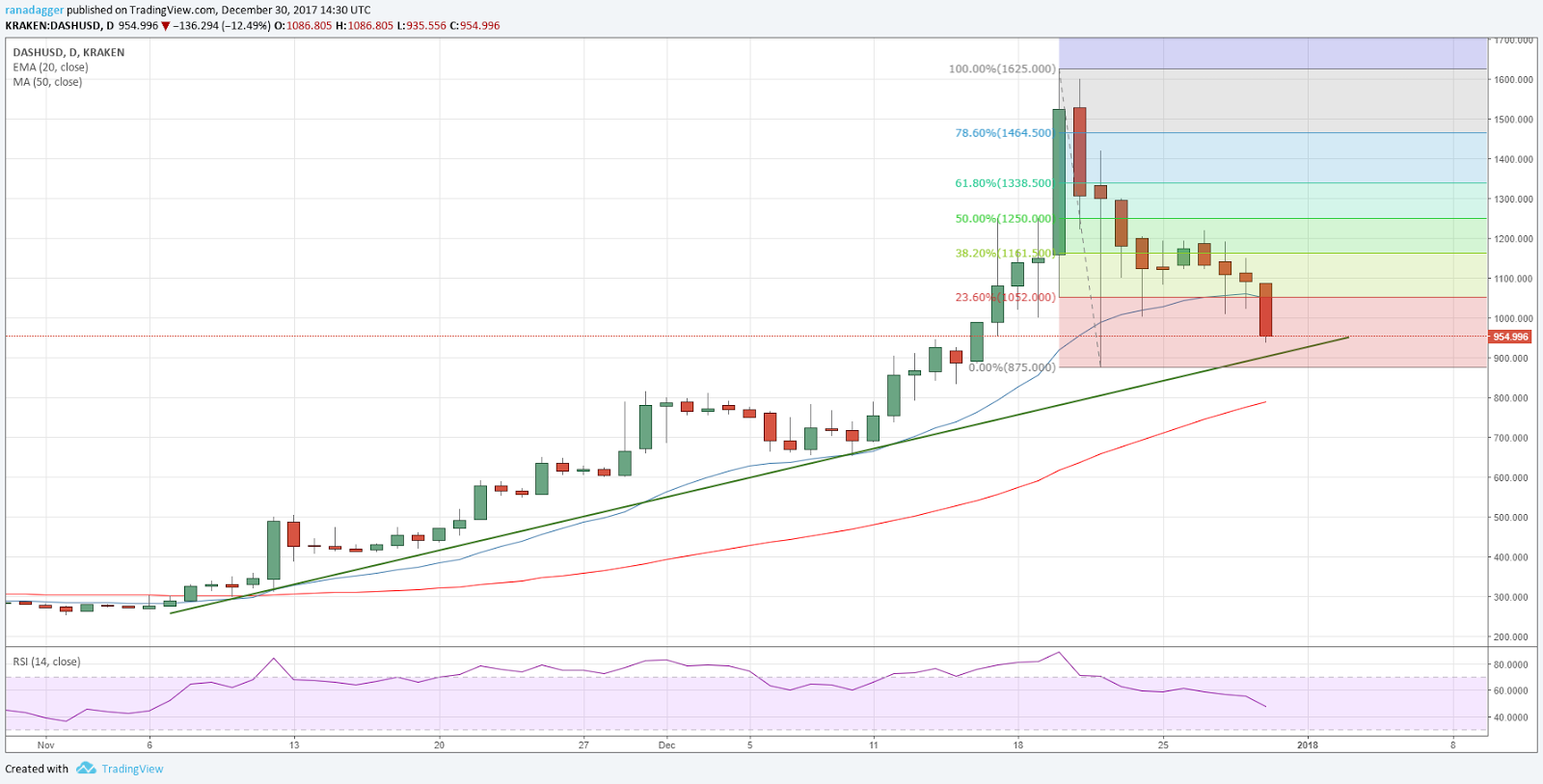

DASH/USD

For the past two days, the bulls managed to hold on to the 20-day EMA. But today, the bears have broken below the moving average support.

Dash has a strong support at the trendline. We expect the bulls to strongly defend this level.

Though we shall avoid buying until we get a confirmation of a bottom formation because if the trendline breaks, the DASH/USD pair can fall to $800 and thereafter to $650 levels.

XMR/USD

We were expecting a range-bound trading action in Monero. Despite that, the bears have taken control and have broken below the 20-day EMA today, which is a bearish development.

The immediate support on Monero is at $300. If this level breaks down, we are likely to see the decline extend to the recent lows of $245.1. The 50-day SMA is also at this level. Just below there is the 61.8 percent Fibonacci retracement level of $230.66.

We expect a strong support in this zone. At the same time, we don’t suggest buying until the fall is arrested.

When the markets are in a bear grip, it is a good strategy to wait until the decline ends, instead of being brave and attempting to catch a falling knife.

Author: Rakesh Upadhyay

Posted By David Ogden Entrepreneur

David – http://markethive.com/david-ogden