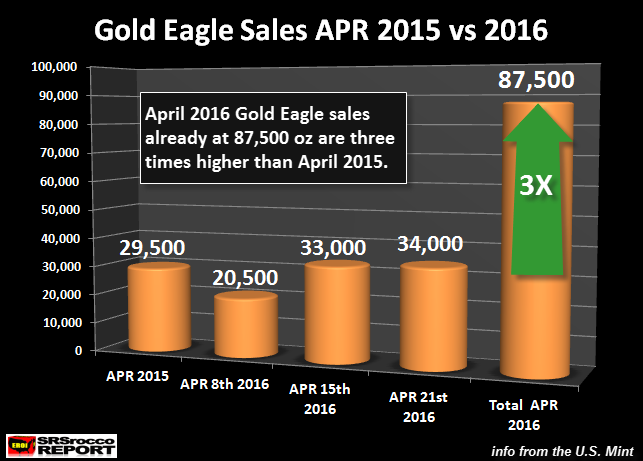

Earlier today, SRS Rocco published an article on how gold bullion sales for April at the U.S. Mint are up 300% from the same month just a year ago, and this is just in the first three weeks of the month.

The telltale sign that something isn’t right in the financial industry is a surge in Gold Eagle sales. Last year, total Gold Eagle sales for April equaled 29,500 oz. However, in just the first three weeks of April this year, Gold Eagle sales have reached 87,500. This is three times last years figures and we still have another week remaining in the month:

But purchases from the U.S. Mint don't tell the whole story. According to analyst and economist Jim Rickards this week, central banks as well as elites are purchasing their own gold stashes at record levels, in preparation for the fourth potential collapse of the global financial system in the past 100 years.

Countries are also acquiring gold in advance of a collapse of the international monetary system. The system has collapsed three times in the past century. Each time, major financial powers came together to write new rules.

This happened at Genoa in 1922, Bretton Woods in 1944, and the Smithsonian Institution in 1971. The international monetary system has a shelf life of about 30 years.

It has been 30 years since the Louvre Accord (an upgrade to the Smithsonian Agreement). This does not mean the system will collapse tomorrow, but no one should be surprised if it does. When the financial powers next convene to reform the system, there will be no appetite for the dollar’s exorbitant privilege.

The Chinese yuan and Russia ruble are not true reserve currencies. The only feasible benchmarks for a new system are the IMF’s world money, called special drawing rights, and gold.

Critics claim there is not enough gold to support the financial system. That’s nonsense. There is always enough gold, it’s just a matter of price.

Based on the M1 money supplies of China, the eurozone, and the US, and with 40pc gold backing, the implied non-deflationary price of gold is $10,000 per ounce.

At that price, a stable gold-backed monetary system could be sustained. When it comes to monetary elites, watch what they do, not what they say.

While elites disparage gold at every opportunity, they are buying it, hoarding it, and preparing for the day when one’s gold determines one’s seat at the table of systemic reform.

Just how much of the house do you need to see BURNING before you seek safety for you and your family? Don't you think it’s past time to claim your seat with an asset allocation to physical GOLD? – Open your FREE GOLD Savings Account with KARATBARS to protect your family's economy, and let us help you get started, TODAY! Please share this post with everyone you love and care about. Go to:TheFuturePlan

David – http://markethive.com/david-ogden